It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

How To Easily Create A No-Sew Custom Scarf

What's warm and cozy and looks great...a Custom Scarf! Scarves sure have come back into style as not only something to keep you warm and cozy, but as a great fashion piece too. From infinity to blanket scarves, they just look so great and can be...

How To Make Ammonia Free Glass Cleaner You'll Love

Have you seen the prices of ammonia free glass cleaner lately? Wow! It is so expensive. Over $4 for just one bottle! I was astounded the last time I had to purchase a bottle and my gut just sank. Buying my family good quality food is something we...

How To Make Simple Aprons Without Sewing

There is nothing like a bunch of us girls in the kitchen with our aprons on working on our holiday baking list. And of course we're listening to Christmas music and there's always a bit of silly dancing happening too. It's such a special time...

How To Make A Cheap Leather Sofa Cleaner That Works

There are several furniture pieces in my home that I love, my leather sofa and my leather office chair. While they are great, they seem to get the most dirt, and I'll admit, coffee spills from me especially on my office chair. We paid the extra...

How To Make The Cutest Monogrammed Welcome Mat

Do you know of someone you love with a worn out welcome mat? No, I'm not talking about their attitude...I'm talking about making some great gifts this year! Welcome mats are the first thing that make people feel welcome into your home. So let's...

How To Clean A Stinking Garbage Disposal Easily

How stinky is your stinking garbage disposal? Mine gets pretty stinky. My kitchen helpers (aka, my kids) often forget to run the stinking garbage disposal when they are on kitchen duty. They also conveniently forget to actually clean the stinking...

How To Make The Best Swarovski Crystal Sun Catcher Gifts

I love Swarovski crystal sun catchers, don't you?! They just bring in so much light and magic to a room, that it makes my heart skip a beat. Do you have a sun catcher memory? Mine goes back to my grandmothers living room. She had beautiful crystal...

How To Make The Cheapest Wood Furniture Cleaner

They say "judge not, lest you be judged"... so please remember that when you look at my "before" pictures of using my DIY wood furniture cleaner. You see, my name is Kati Kiefer, not Martha Stewart. I do not have a cleaning crew nor a maid. And we...

How To Make The Easiest Family Command Center

Do you have a command center in your home? We do and it's amazing! From writing notes and stashing mail and keys, it's a great way to stay organized with the craziness of life. But what better gift to help your mommy friends and family stay...

AS SEEN ON:

Where Can I Serve You First?

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

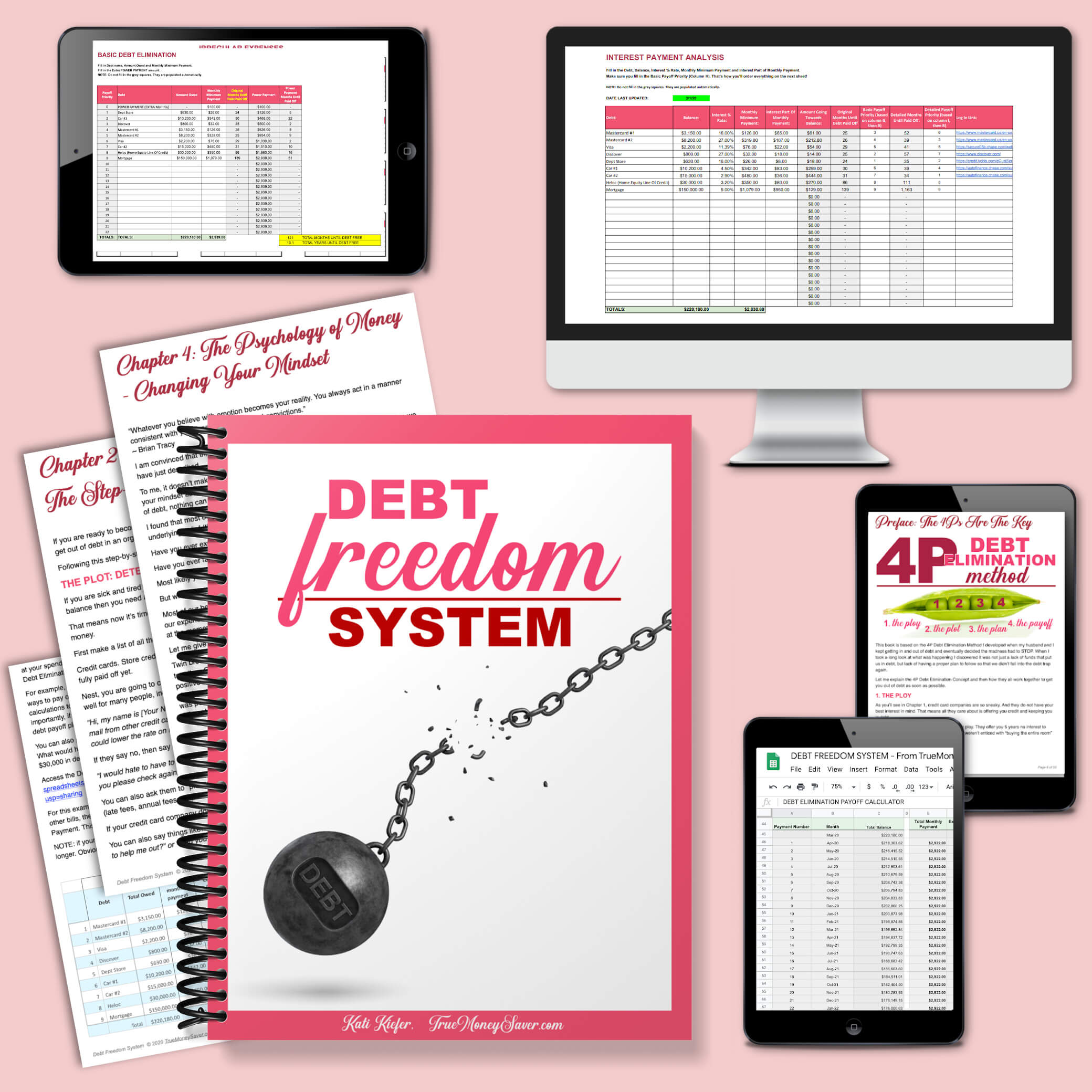

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Best Selling Products

JumpStart Your Savings

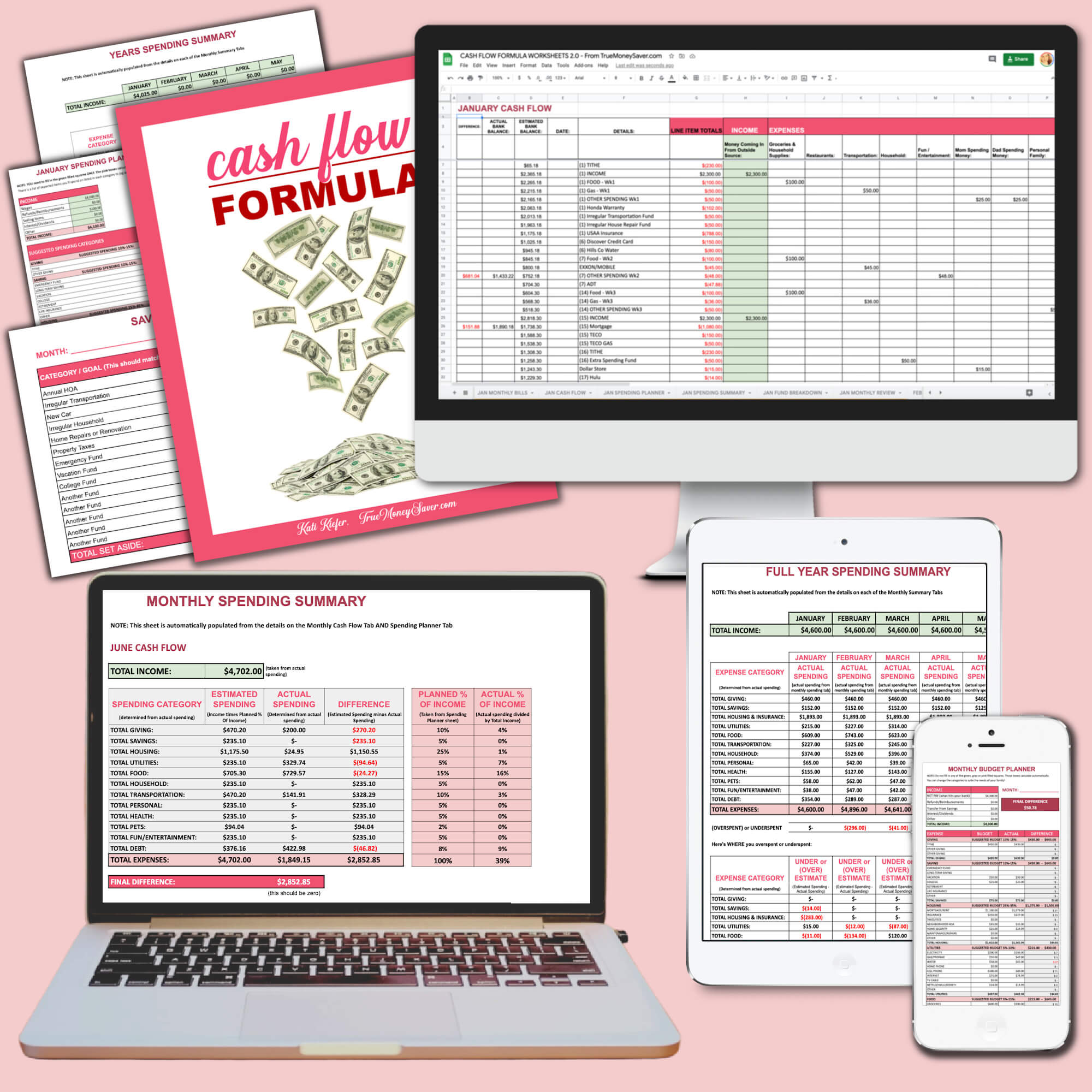

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)