It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

How To Make The Best Cutting Board For Gifts This Year

The best cutting boards are the ones you use for ages. The one my mother still has to this day is the one I used to chop veggies on when I was a kid. How is it that a piece of aged and worn wood brings some comfort and memories to you each time you...

How To Make The Best Dryer Sheets For Just Pennies

It was her confrontation that led me to the best dryer sheets I could find. Although I love my mom dearly, she is a natural guru. She loves and uses all things natural and she confronted me about using dryer sheets. Since there are tons of...

The Best Homemade Flavored Salt Recipes You'll Love To Make

Last year my husband James was given some of the best flavored salts for Christmas and I knew they were super expensive so I learned how to create some homemade flavored salt recipes to include in my gift giving this year. The thought of licorice...

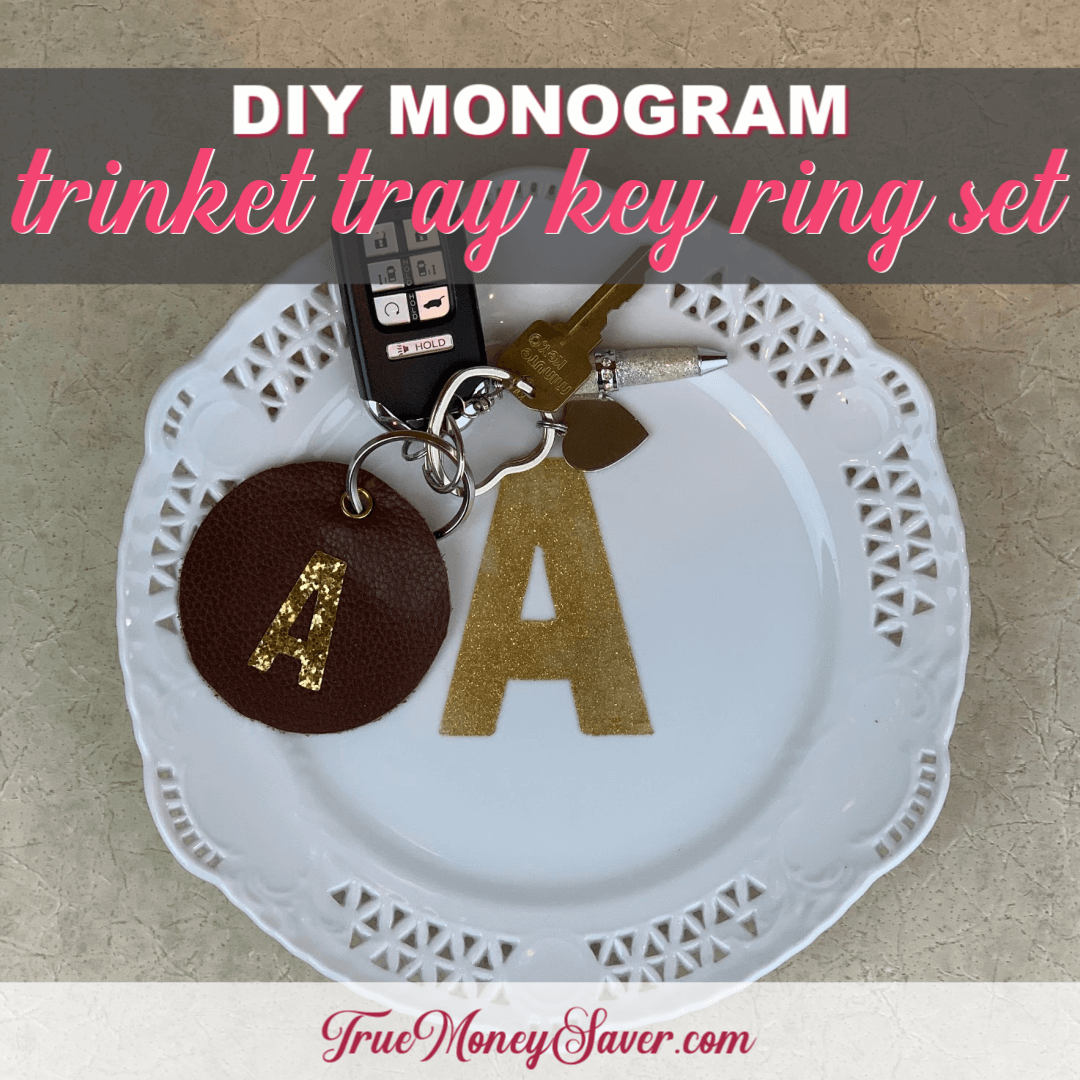

How To Make The Cutest Monogrammed Trinket Tray & Matching Key Chain Set

Raise your hand if you're in need of a trinket tray! You know, the tray that you put everything into as you walk in the door so it doesn't grow legs and walk off? Yup, that kind of trinket tray. While I don't personally need one at the moment, I...

How To Make The Best Car Air Freshener For Pennies

We all know that I have boys...smelly, stinky boys and in order to survive another car trip I needed to find the best car air freshener with essential oils. On our recent car trip, we decided to stop for dinner and then get back on the road. A half...

How To Make A Monogrammed Waterproof Tote Bag

Have you ever wished you had a waterproof tote bag? Believe it or not, but the Sunshine State where I live has a LOT of rain. It never fails that I head somewhere with my tote bag full of either library books or snacks and I need to sit it down and...

The Best Homemade Fabric Refresher You Can Make Today

I needed a homemade fabric refresher with essential oils like last week because my car became so smelly. My boys get smelly, very smelly. They play disc golf outside in the Florida heat. And then they get rained on and they accumulate mud as well....

How To Make The Best Personalized Makeup Bags In Minutes

I'm convinced that personalized makeup bags might just be the best thing ever. They have SO many uses. Little zippered bags are such great organizers and keep all the small things you need contained. To make this DIY no-sew makeup bag you'll use...

How To Deodorize Carpet (Or Rugs) With A Scent You'll Love

You know I have a big family with lots of kids and cats, and that means I am constantly trying to learn how to deodorize carpet and rugs... fast! Usually right before guests are about to stop by (because being prepared is no fun!). And usually,...

AS SEEN ON:

Where Can I Serve You First?

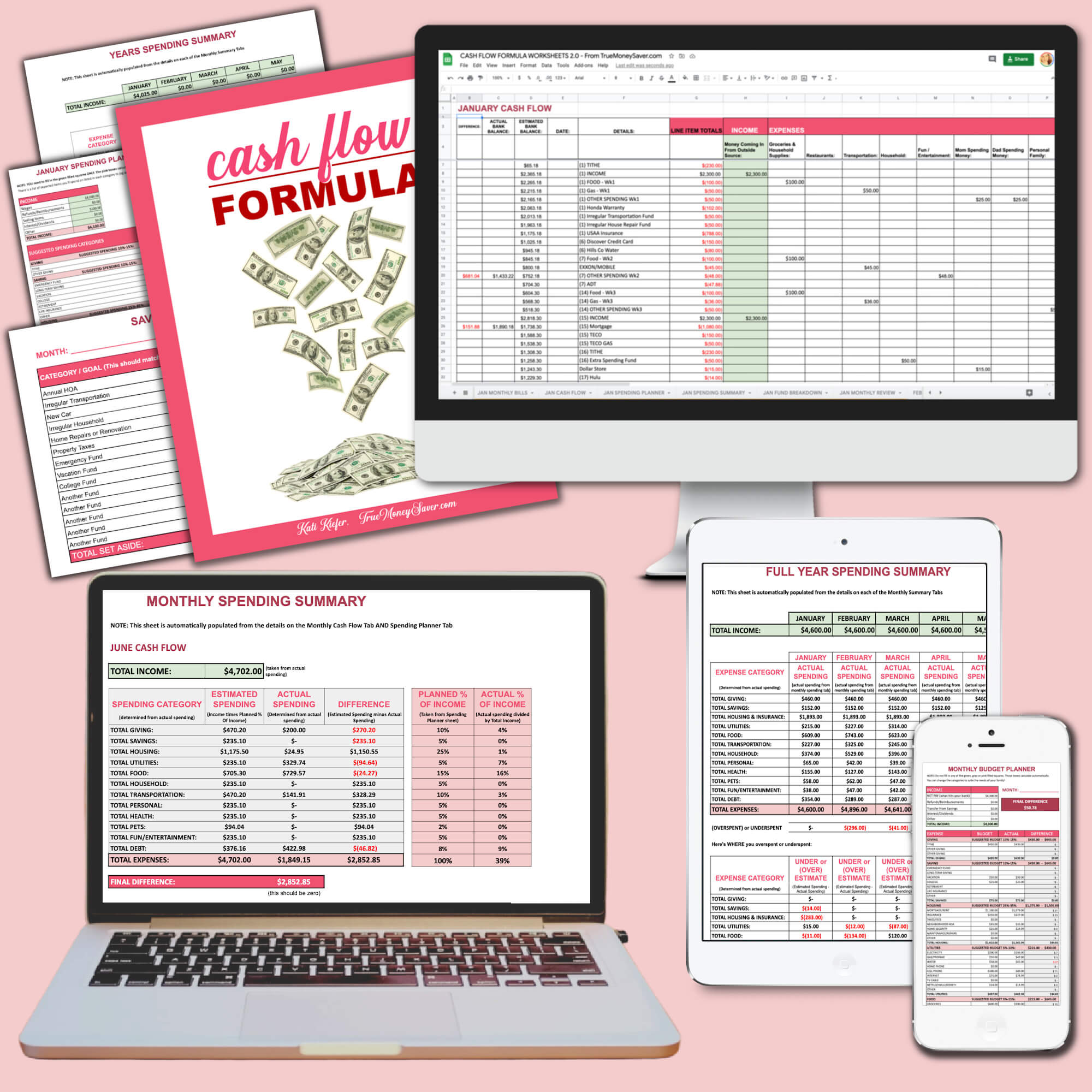

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

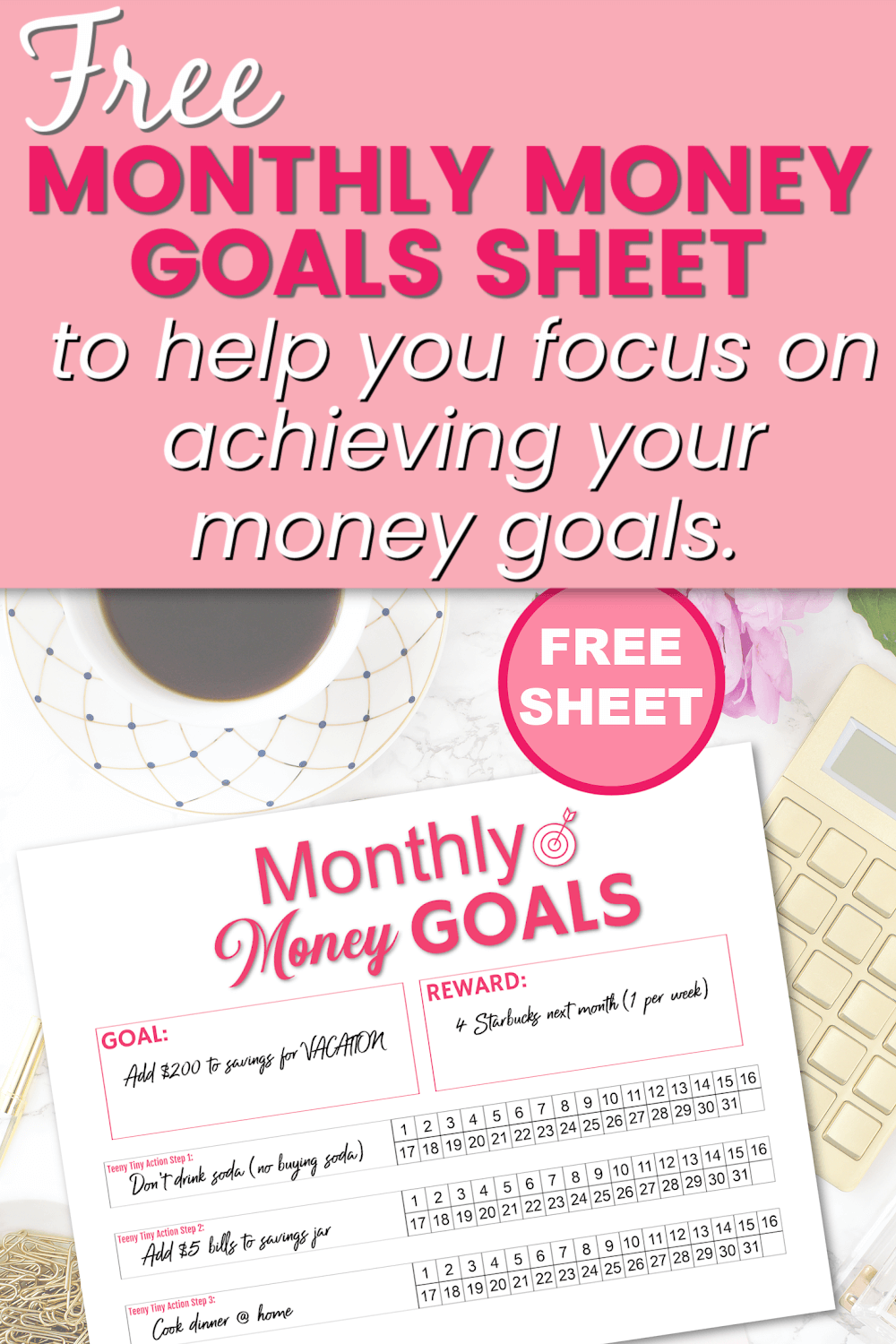

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

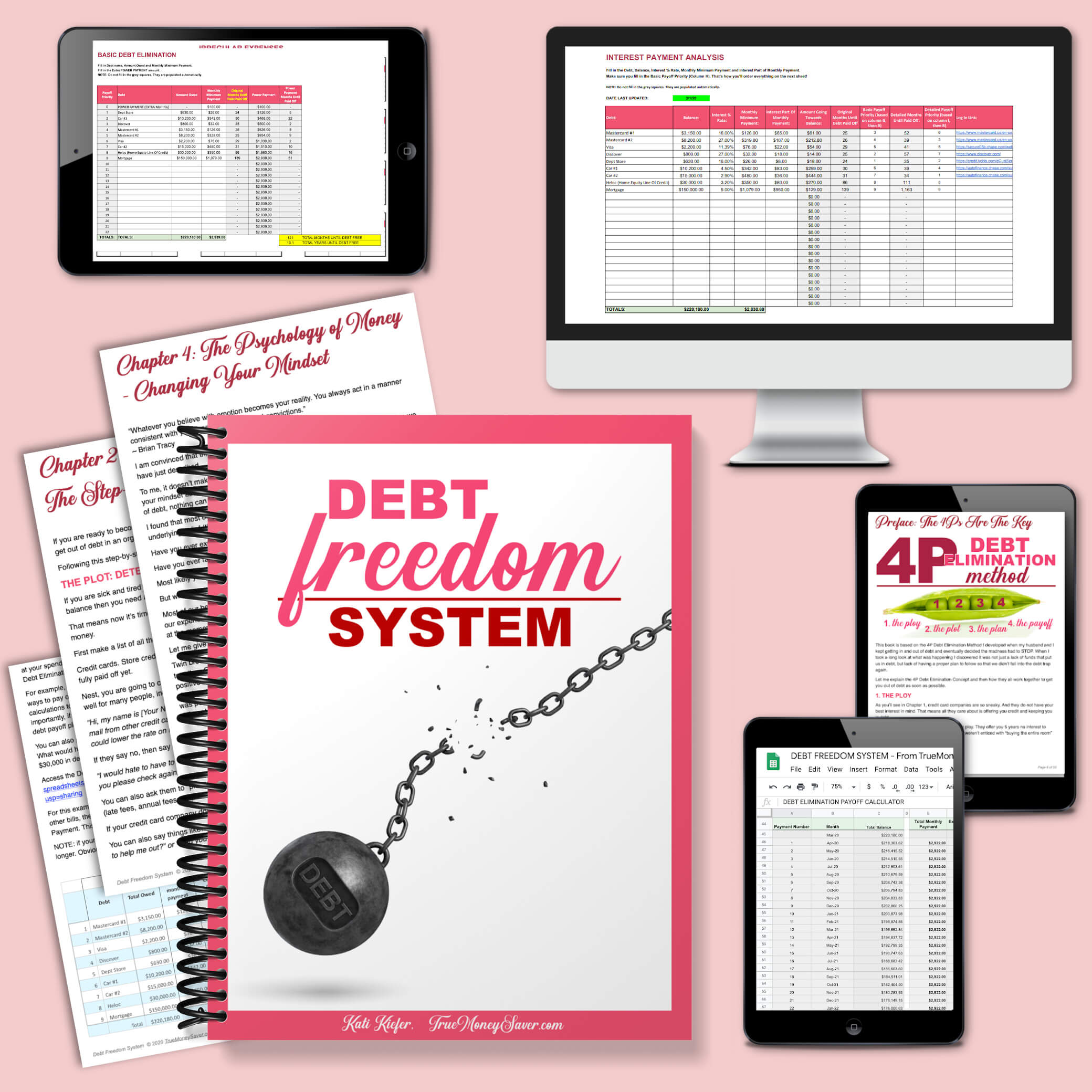

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Best Selling Products

JumpStart Your Savings

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)