For years, I struggled financially with setting personal goals, overspending, and being discontent with the things I already had.

For years, I struggled financially with setting personal goals, overspending, and being discontent with the things I already had.

For myself, I made enormous financial goals in hopes of achieving this dream of mine, only to find myself no closer than when I had started.

I was tired of not reaching my financial goals and being disappointed when I was stuck in the same place a year later.

I was desperate to see even the slightest bit of progress and ended up no closer to my financial goals than I was when I made them.

It was because of this significant failure that I learned how to actually start achieving my financial goals.

Believe it or not, there is a science to setting personal goals and achieving those big financial goals.

By setting your personal goals now, you can quickly reach them sooner!

Plus, the motivation for your financial goals will come easier once you start seeing your success.

And, having financial planning goals benefits you by making you accountable because the goals you create are the ones you really want to accomplish.

Whether you are trying to finally pay off that debt that’s weighing you down, lose the weight you’ve been trying to get rid of for years, or just put your life back together, let me explain how my system will work for your finances too.

Break Down Your Goals Into Bite-Sized Chunks

If you have a big overwhelming financial planning goals, sometimes breaking it down into smaller bite-sized pieces can help make that big scary goal seem a little easier to accomplish.

If you create a 5 year plan, this can still be done in chunks.

Start by writing down your starting point and your end point when setting personal goals.

Think about what it is going to take to reach your bigger financial planning goals.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

If you are paying off debt, think about milestones you can meet and a time frame for those milestones.

Maybe your milestones will be every $500 or $1,000 you pay off. Or it might be when you pay off each debt.

In between each milestone, write down exactly what you need to do to get from where you are now to meeting that goal. These are your bite-sized goals to help you reach your big goal!

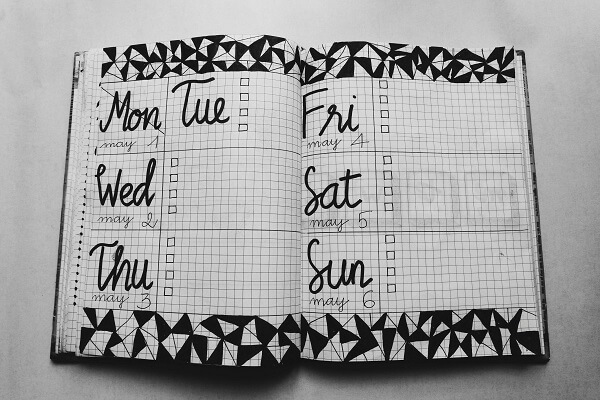

Write It Down

I can’t stress enough how helpful it is setting personal goals and to write these goals down.

Your brain processes things differently when they are written down (yes, by hand). Plus, there is just something about having it all down on paper that makes you feel more accountable!

You can use a fill-in-the-blank printable, a blank piece of paper to write down your goals. However you do it, make sure you write it down and share it with a few close people. This will help you stay not only accountable but also make sure you don’t forget about them.

To keep the motivation for your financial goals is by keeping your goals in plain sight. Paste them on the bathroom mirror, add a sticky note to your wallet and your car dashboard. The more you see it, the more you are apt to keep your goals going!

Make Them Realistic

If you haven’t even thought of a business idea, you probably won’t run a million dollar business by the end of the year.

It’s important when setting personal goals to keep your goals realistic. Also, keep in mind what season of life you are in right now.

If you have a baby, it might not be practical for you to get eight hours of sleep every night, if you’ll be up all night with your baby.

When you are setting your goals, dream big! However, make sure that they are within the confines of what you can reasonably do for the season of life you are in right now.

The motivation for your financial goals are to keep them tangible and doable. Believe in your goal that you can achieve it and you will!

Here are some more tips to making realistic financial goals.

Schedule Time To Work On Your Goals

Just like you make time for planning your meals, you also need to make time to work on your goals!

If your goal was to pay off debt this year, and you need to work three hours a day on your side hustle to make enough money for an extra payment, get to it!

Schedule time every day to work on your side hustle so that you don’t let your dreams fall by the wayside.

I schedule an appointment with myself every Saturday afternoon to plan out my priorities for the coming week. I review what happened the past week. That sets up my week for the truly important things, instead of tending to the tyranny of the urgent each day.

Setting personal goals should include spending time each week to work on them.

Make Goals You Actually Care About

If early retirement doesn’t interest you, then making a goal to retire early isn’t going to do you any good.

Think (I mean REALLY ponder) about setting personal goals. Make sure your goals are something you are interested in and care about.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Last year one of my goals was to clean out my inbox (it was over 4,000 deep). That might not matter to most of my friends but I was having a hard time focusing each day worrying that I was missing an important email in my inbox because it wasn’t sorted properly.

I set a goal to clean out 50 emails and it took months to accomplish the goal. I’ve had a zero inbox for months now and it feels SO good.

Remember that any goal that matters TO YOU is still a worthwhile goal!

Get Your Spouse Involved

When setting personal goals, If you are working on a finance goal, it’s pretty safe to say it’s going to require your spouse and family members to get it accomplished.

Have a “family meeting” over dinner and talk about your goals and ideas. You might want to figure out a separate set of “Family Goals” that impact the whole family, such as cleaning out everyone’s closets by a certain date. Or holding a monthly yard sale to raise a certain amount of money to pay off debt.

Having multiple people on board will hold you accountable, and it will help make sure you reach your big goals.

Make sure you’re not only making goals but writing them down as well.

By setting your personal goals now, you can quickly reach them sooner!

And, the motivation for your financial goals will come easier once you start seeing your success.

Plus, having financial planning goals benefits you by making you accountable because the goals you create are the ones you really want to accomplish.

Writing down your goals helps ensure you don’t forget them later on and serves as a constant reminder of the things you hope to achieve someday.

YOUR TURN: Have you started setting personal goals this year? Which current goal is on your list and what are you doing to stay motivated to reach it? Let me know in the comments below!