Was the way of saving money with the Spending Freeze Challenge successful?

Was the way of saving money with the Spending Freeze Challenge successful?

Are you looking forward to the little extra money in your bank account at the end of the month?

My desire to put the extra money to pay off debt turned into a vacation fund for my family, a way to boost our savings account, and so much more.

Whether you are doing a Spending Freeze Challenge to save up for a vacation, or just to keep your family from spending money, this can be such a helpful way to reset your finances.

However, I’ll be the first to admit that participating in a Spending Freeze is not easy. But it is definitely worth it.

Not only do you get a chance to “reset” your finances, but you gain a deeper appreciation for what you already own.

We live in a materialistic society, where shopping is just a part of everyday life. We seek instant gratification and shop on impulse.

Completing a Spending Freeze Challenge means you’ve been intentional with your spending and managed to use up the things you already had. That’s huge!

After Your Spending Freeze Is Over…

you could run out and start swiping your debit and credit cards and never skip a beat, or, what I hope you will do, is evaluate your spending and be intentional as you spend money in the days ahead.

Because the Spending Freeze Challenge is truly to get you to look at a few things including your spending habits.

After your Spending Freeze, I would hope the no spend motivation would still be there to help you evaluate your needs and wants even further.

And, during your Spending Freeze, I would hope the no-spend challenge for frugal living would encourage you to delve further into your need to spending habits so you can stay on track for saving more money.

Here are a few of the lessons I learned while on a spending freeze that can help encourage you to keep saving money after your spending freeze is over.

Quickly Calculate Your Savings

The first thing (and most exciting thing) to do after your Spending Freeze Challenge is over is to calculate how much you’ve saved.

And it’s WAY EASIER than you probably think.

While this is not a super scientific accurate method (and you probably know as an accountant, I LOVE my accounting methods…) but this is a fast enough exercise that you can accomplish so that you’ll be using the no spend motivation to keeping a few new habits into next month.

Basically, take a look at your bank account from the same day of last month. Notice how much more money is in there. Just a quick glance will show you where your money was going before the freeze and how much more you likely have now.

You’ll finally see how this way of saving money can make a huge impact on your family!

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

And it was all saved because you sort of “froze your liquid assets”. In other words, you pretended like your money wasn’t even there, forcing you to choose alternatives to get through the month and keeping you from haphazardly spending money.

Now that you’ve seen how this way of saving money is somewhat easy, you might keep doing some of those Spending Freeze Challenge habits such as not drinking soda next month. Or maybe after doing these frugal new habits for the last 30 days, you now have a rhythm for planning your meals or lunches and you can continue saving money by sticking to your new habits.

Shop More Focused

Going into a store like Target or another store can be an extremely difficult way of saving money. It’s easy to lose focus and spend more than you had intended.

When I go into these stores now, I’m not digging through sale bins or “just browsing.” My shopping trips have a purpose, and I’m focused on that purpose.

During this spending freeze, I learned only to buy things that I genuinely need, and this has carried over into my shopping trips as well. It has helped keep this no-spend challenge for frugal living going!

The Live On Less Way Of Saving

This doesn’t just apply to stuff, but food as well.

During our spending freeze, I learned to be more content with the things I had, what was available to me, and accept the things I cannot change.

This helped tremendously with my way of saving money.

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

In reality, we usually overestimate how much we need in our lives, and overspend because of it.

Now I know one more way of saving money in my grocery budget by overestimating grocery buying.

Re-Evaluate Your True “Needs”

Many things I once thought were necessities turned out to be just “wants” instead of “needs” with this way of saving money.

During our spending freeze, we chose not to eat out and only use the food we had in the house.

On nights when things were crazy, or we got busy, eating out wasn’t an option, so we did something else instead.

We packed lunches and brought them with us, kept snacks and drinks on hand while we were out.

Here are some lunch ideas just for you!

Cut Out The Extras

This goes along the same lines as reevaluating your needs, but what do I mean by extras? I mean anything that is not considered a necessity for you to survive should be analyzed if you truly want to spend on it and forego a bigger goal such as paying off debt.

The famous financial guru, Dave Ramsey, refers to this as having “Gazelle-like intensity” and it means that you are SO focused on your goal, you will forego normal living in order to get your debt paid off asap. Even if “asap” takes a few years.

I’m less drastic with my way of saving money than Dave because I think there needs to be a little living in this intense period.

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

However, as you go through a spending freeze, you realize that things such as Netflix, haircuts, and even gifts are considered optional and it IS very possible to come up with a cheaper (or free) alternative.

Once the month is over, and you have a nice chunk of cash to show for all that effort and lack of spending, you’ll have a clearer view of what is truly “extra” and which you might be able to continue to live without.

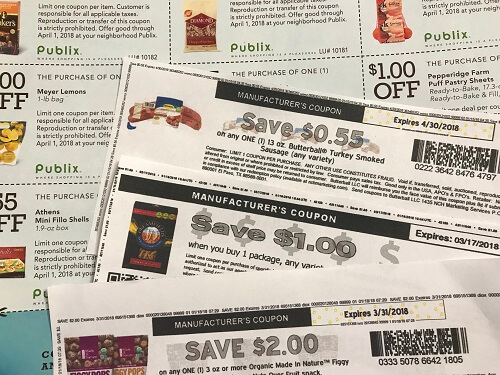

Start Using Coupons

For most people, when you go on a spending freeze you won’t be able to survive on what you have in the fridge, pantry, and freezer without also filling in with some grocery store items. This might be fruits and vegetables midway through the month, milk (or half n half) when you run out, or eggs.

Couponing is a great way to pay for your groceries instead of your own cash, even when you are allowed to spend money!

It’s one way of saving money that is really easy to do.

Using coupons can be a great way to stretch your monthly grocery budget. Look for coupons and match them with sales at your grocery store to walk out with great deals for just pennies.

Plus, you can ease into it by just using printable coupons (instead of needing to buy the newspaper for the coupons). Couponing can be a short-term hobby for this month just to help you get WAY more for your money as you start spending again.

It’s a way of saving money without a lot of extra effort.

Because the Spending Freeze Challenge is truly to get you to look at a few things including your spending habits.

After your Spending Freeze, I would hope the no spend motivation would still be there to help you evaluate your needs and wants even further.

And, during your Spending Freeze, I would hope the no-spend challenge for frugal living would encourage you to delve further into your need to spending habits so you can stay on track for saving more money.

YOUR TURN: What would you spend even just $500 on after your Spending Freeze was over? Would you add it to savings? Or maybe a family vacation? Was this way of saving money a success for you? Let me know in the comments below!