How do you go about planning for your financial future?

How do you go about planning for your financial future?

Think back to five years ago.

Are you where you wanted to be now? Do you even remember where you wanted to be five years ago?

This is perhaps one of life’s hardest questions since a lot can change in just five years.

Many people probably answered no to the above questions, and unless you are focused on your future, you will likely continue to respond no for years to come.

Your day to day life is going to continue to weigh heavily on you, and the bigger things in life will just keep getting pushed back to the bottom of your to-do list.

Whether it’s paying off your student loan debt, becoming financially independent, or just being in a better financial place than you are now, it’s so important to have a five-year plan.

Maybe you are thinking to yourself “5 years?! I can barely think about five minutes from now,” but I promise you that in five years, you’ll be glad you started today!

Because your future financial planning is important and I want you to be successful with your finances.

I’ll show you how to make a five-year financial plan so that you can finally get your finances on board with your dreams and goals.

And it’s super easy! In fact, it only takes 4 steps to create a successful financial plan:

- Visualize Where You Want To Be

- Break Down Your Vision Into Sections

- Set Up The Action Steps To Ensure Success

- Make An Appointment (With Yourself)

By planning your financial future you’ll be making your financial planning goals a reality.

If you are ready to begin creating your five-year financial plan today, here’s how to get started!

Step 1: Visualize Where You Want To Be

The hardest part is figuring out where we want to be five years from now. But this is the major part of planning your financial future.

Do you want to have your mortgage paid off? (so you’d need to accelerate your payments) Do you want to spend more time with your kids? (maybe quitting a job to stay home with them) What about traveling to distant places? (meaning you’ll need to start putting aside money right away)

Ask yourself these questions and imagine what your life would be like in your ideal world.

Not only will this exercise show you what is most important to you, but also what things don’t matter. Start dreaming to make your future financial planning a reality.

Does your vision include sitting in front of the TV or ordering takeout pizza? I doubt it. And NOW is the time to set your course.

You can even make a visual tracker for your finances to keep front and center so you stay on track throughout the year. This can help you to see your dreams and goals for your finances so they stay current in your mind. When you see the tracker each day, it helps keep you motivated.

This also helps us keep into sight what is important and why you made your financial goals in the first place.

This can be a huge step in planning your financial future. Keeping your goals within view every day can be huge in keeping you motivated.

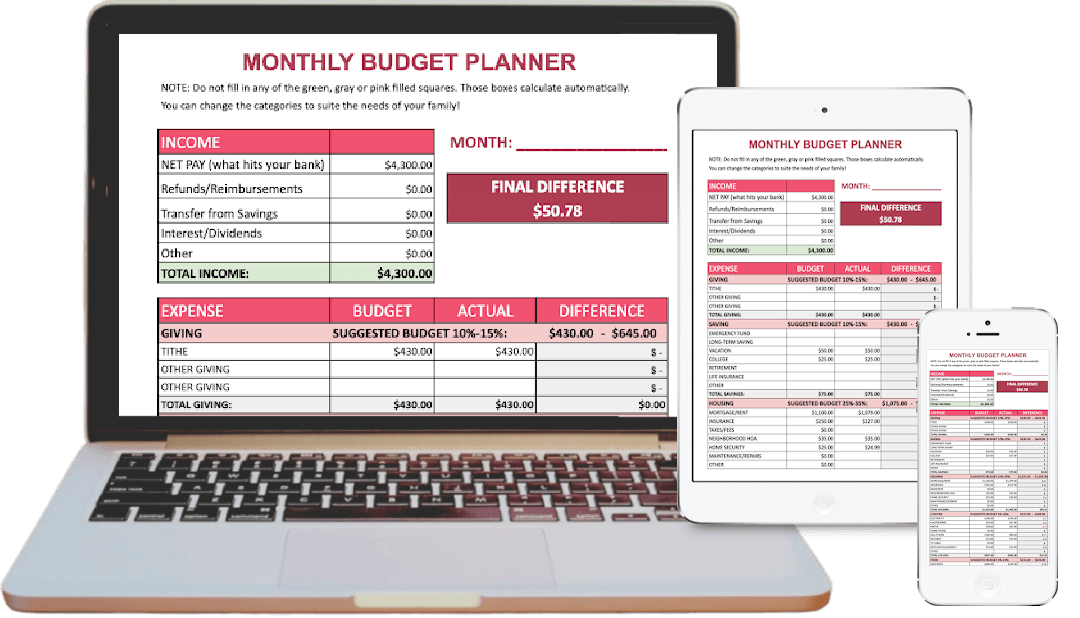

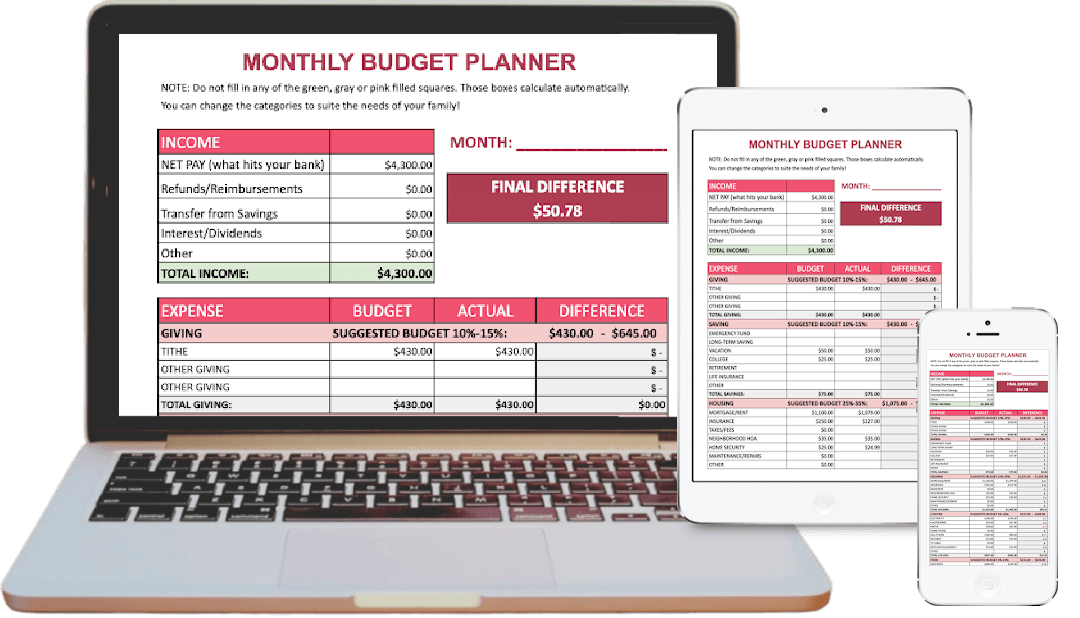

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Step 2: Break Down Your Vision Into Sections

Tough Love: If you do nothing, you will be no closer to your five-year goal than you are right now.

Yes, I realize it is going to take some work when planning your financial future, which is why you need to break down your vision into actionable steps you can take over the next 5 years.

Take a piece of paper and divide it up into five sections.

This will be one section for each year of your plan.

Write down what your vision looks like and what things stick out to you to accomplish each year, this might change as you go but for now this is a good start and gets it out of your mind.

When you learn how to make a five year financial plan, you’ll be more apt to make those dreams a reality. And writing them down means you have a much greater chance of accomplishing them. (Go you!)

Step 3: Set Up Action Steps To Ensure Success

Start with your big goal and work backward planning your financial future to find out what you need to accomplish to reach your goals.

That means it’s time to brainstorm alllllllllllllll the ways you can accomplish the goals you wrote down to accomplish over the next 5 years.

For example, if you want to save up for a big vacation next year, then you’ll want to estimate how much it’s going to cost you and divide it by how many months you have until you need to pay for everything (not how long before the vacation is happening, you’ll need the money much sooner than that). It might even be more beneficial to further divide that number by how many weeks you have until you need the money. That way you will be able to purpose to either cut expenses each week to set aside extra for your vacation fund or figure out creative ways to make extra money to put towards it.

When thinking of these tasks, make sure they are specific and that even your smallest job has a purpose.

Now go back to your piece of paper and write in your jobs and a timeline for each task. Let’s put those financial planning goals into motion.

Step 4: Make An Appointment (With Yourself)

While planning your financial future is an excellent roadmap for getting you closer to your goals, it won’t do you any good if you don’t follow your plan.

One of the most common reasons people don’t reach their five-year goals aren’t because of a lack of planning, but because they don’t follow through with the plan. UGH!

Schedule time to work on your goals every single week. Schedule it just like any other appointment. Review where you are, and how your progress is going. If you use the visual savings trackers this’ll be a fun time to update them and color the next level of savings!

When you make an appointment with yourself, it will make sure you have time to accomplish your goals, so that you aren’t stuck waiting until the end of the year to put in all the work.

Don’t wait to put your future financial planning tasks into action. You can’t procrastinate and expect to get anywhere!

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Understand That Things Change

On a final note, know that nothing in life is set in stone and your entire life could change tomorrow. Your vision for planning your financial future from earlier might be entirely different a year from now.

The long-term plan you create should adapt and change your life, as your goals change. This five-year plan is meant to help you focus on your goals and give you an idea of how to reach those goals.

Some plans may need to be put on hold, and other goals might be more critical now. The point is to set yourself up for success by creating a map toward that big goal.

Five years from now, your life can be different.

Because your future financial planning is imporant and I want you to be successful with your finances.

When you learn how to make a five year financial plan you can finally get your finances on board with your dreams and goals.

Plus, when you start planning your financial future you’ll be making those financial planning goals a reality.

You have no idea what the future holds, but if you have a five-year plan than you will have a roadmap to where you want to be.

YOUR TURN: What goals can you include in your planning your financial future? What steps can you take each day towards your five year plan? Let me know in the comments below!