Have you ever done a 52 week money saving challenge?

Have you ever done a 52 week money saving challenge?

I am a huge proponent for saving money. Especially when it’s easy and fun.

When I realized that my family could save over $600 by simply collecting pennies… I was wholeheartedly on board!

You might have seen something called a “52 Week Money Saving Challenge” circulating on social media.

But the typical “challenge” that circulates is pretty hard for the average family to complete. It involves saving $1 for each week of the year, which sounds easy enough, but not just $1, it’s $1 times the week of the year it is.

So on the 52nd week, you have to put $52 in the money jar. That means during the 4 weeks of December, you will need to come up with over $200. And I don’t know about you, but December is when I want to spend all our money (on Christmas presents for our kids).

Instead of doing the usual printable 52 week money saving challenge and not being able to complete it during December when you’ve got extra spending for Christmas, I’ve got a few more options.

In fact, I’ve found 10 ways to consistently save money during the year that is easier to implement than the typical 52 week challenge you are used to seeing. You’ll just love these simple saving money tips and ideas.

In fact, these are basically just “simpler” variations of the printable 52 Week Money Saving Challenge to make it easier to complete.

And the best part is you can get your family involved in saving money! They will love this easy easy savings challenge too!

That will ensure you can spend your money during December, instead of feeling like you need to sock it away to save it. I hope you like them!

So let’s get down to saving money!

1. Penny Saving Challenge

The Penny Saving Challenge is a creative printable 52 week money saving challenge that will help you save $670 in one year simply collecting pennies. Talk about an easy savings challenge!

All you do is set aside a penny for each day of the year. Well, for each date of the year.

So 1 penny on day 1 and 5 pennies on day 5 and then $1 (100 pennies) on day 100 and so on.

The most you will ever put in the jar in one day is $3.65 (the very last day of the year).

Plus, this challenge is super easy to pick back up midway through the year if you ever happen to get off track.

But the best news is that, by the end of the year you will have over $670 dollars! That’s a good chunk of pennies!

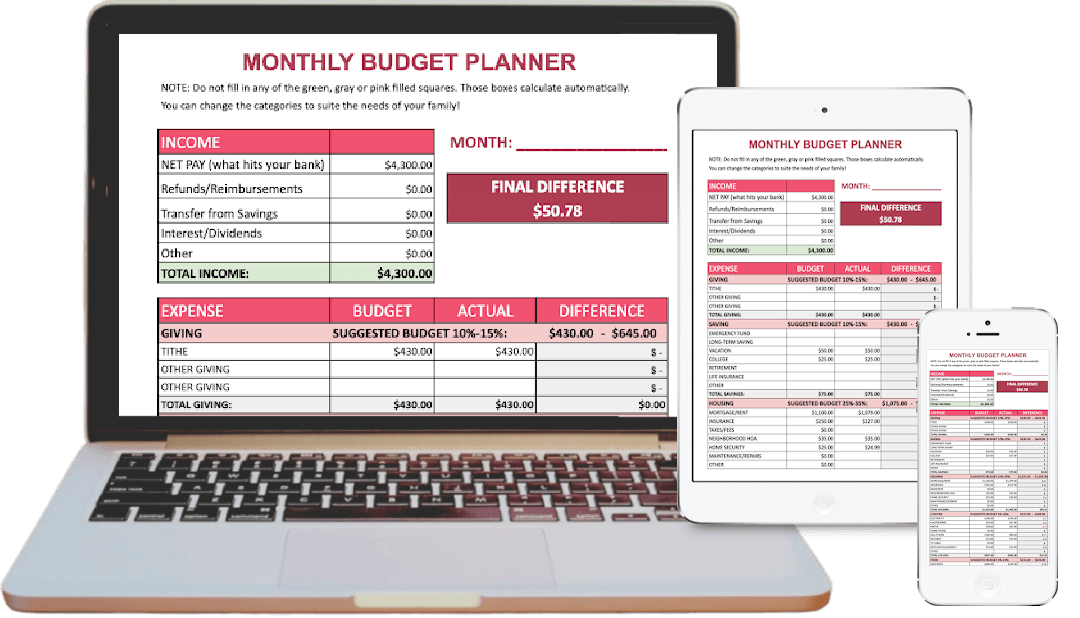

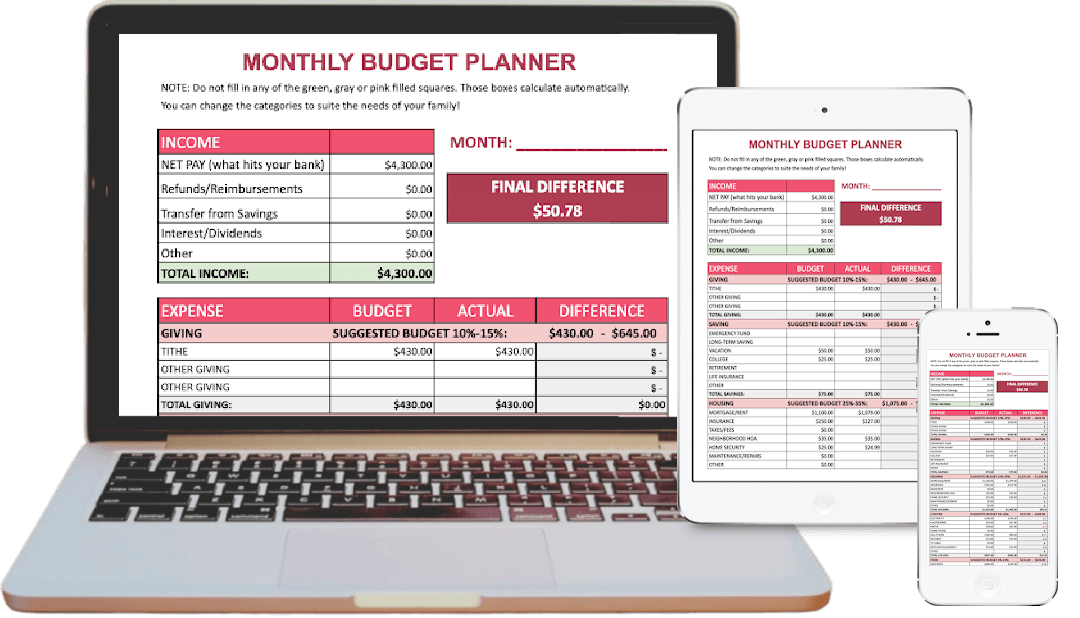

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

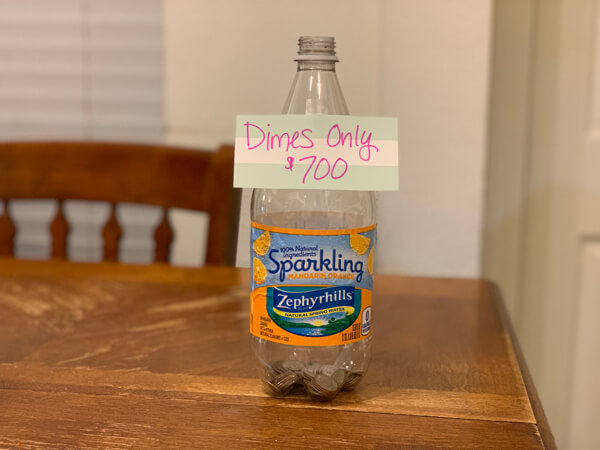

2. Dime Saving Challenge

This challenge circulates on social media every January and my kids and I have begun it but we’ve never actually filled an entire container with dimes to see how much it will save.

Here’s how it works. Every time you come upon a dime, you put it in a 1 Liter bottle.

Supposedly, you will have over $700 when your bottle is all filled.

I’ll have to let you know when we’re done.

Just the challenge alone is fun though because we notice the dimes and everyone sets them aside to put in our jug.

However, they are the smallest US coin, so that means it takes a while to get that many of them. But it’s an easy savings challenge for sure!

2020 UPDATE: We officially filled our Dime Bottle and we just counted it (December 2020) Guess how much was inside? Just UNDER $200. Nowhere NEAR $700… so that’s an internet hoax for sure.

But I was sooooo happy to have the $187 that I used it to buy my hubby a Christmas present (he was so impressed that I was able to keep it a secret because I used CASH so he never saw where I shopped in our bank account. Boo-Ya!)

3. Quarter Saving Challenge

Do you feel like coming up with $1 each week and then $52 the last week of the challenge is too much? How about splitting that in half?

Let’s do it with quarters instead of dollars!

Start by saving 50¢ the first week, and adding 50¢ each week, making the second week $1, then $1.50 the next and so on.

That means the very last week of the challenge you’d deposit $26 instead of $52.

Much more doable!

By the end of the challenge you’ll have $689 total. Simply collecting quarters! It’s one of the best simple saving money tips and ideas!

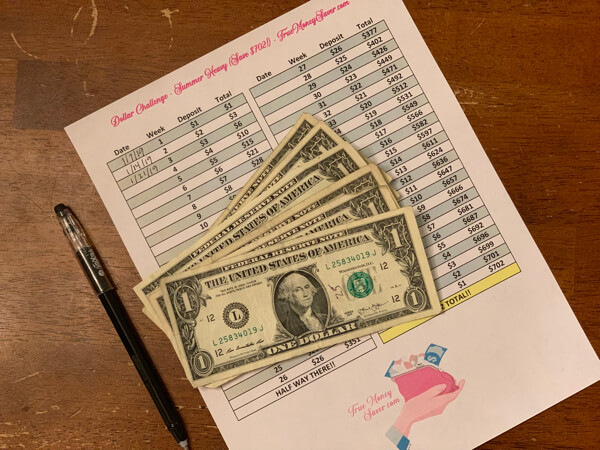

4. Dollar Saving Challenge

This easy savings challenge utilizes the summer months when you might have more time to save a little more money by holding a yard sale or picking up a summer gig to save more money (as a kid, I always watched neighbors pets during the summer when they went on vacation).

The idea is to spread out the savings to make it a little easier during the holidays.

It starts out by adding $1 to your savings each week, $1 the first week, $2 the second week, etc

But it switches the order making the largest deposits during the summer months when you can have a yard sale or have extra time to get creative to earn money.

Then the savings amounts go back down near the end of the year in order to not feel the crunch in November & December.

5. Daily Saving Challenge

The way this challenge works is that every day of the week you put the same dollar amount in a jar.

So on Monday you put in $1, Tuesday $2, Wednesday $3, Thursday $4, Friday $5.

By the end of 50 weeks you’ll have $750.

You could add in $6 on Saturday and $7 on Sunday and that’ll mean over the course of a year, you’ve set aside $1,400 total. Wow.

Spoiler Alert: this is making you save $15 each week ($1 + $2 + $3 + $4 + $5 = $15) But it’s WAY more fun to make a habit for yourself to set aside a certain dollar bill each day of the week.

6. $5 Bill Saving Challenge

Much like the Dime Saving Challenge, when you see a dime, you save it. This works with $5 bills.

Whenever you use cash, and get back a $5 bill… you set it aside and save it.

It’s an easy visual to keep your money and put it aside in savings.

If you can discipline yourself to do this just once a week, you’ll have a cool $260 when the year is over.

That’s a significant amount that you saved only by hiding $5 bills from yourself when you see them, right?

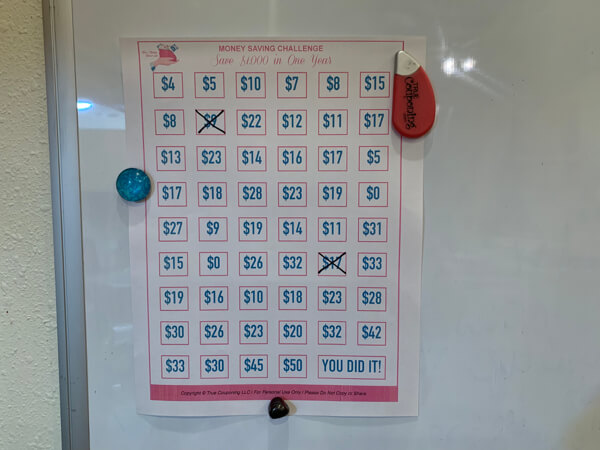

7. Save $1,000 With This Game

If you really want to challenge yourself, then you can use this game to save $1,000 over the course of the year.

Simply color in ONE BOX off the chart per week and by the end of the year you’ll have saved $1,000.

As you can see, there are only two weeks that have $45 and $50, so I’d plan to have a yard sale and use the money to check off those boxes that week.

There are also two $0 boxes to give yourself a couple weeks of reprieve by not having to save anything.

8. Spare Change Challenge

This is also a fun and easy savings challenge.

Years ago a popular bank started a program called “Round up the Change”.

Essentially, every time you used your debit card, they rounded it up to the nearest whole dollar and deposited the difference in a savings account for you.

The best way to spend less money is to switch over to using cash envelopes. And when you use cash… low and behold… you have change!

With this challenge, at the end of the week, empty your purse of all that change and put it into your saving jar. Set an alarm on your calendar or your phone so you don’t forget to empty those pockets!

It’s one of my favorite simple saving money tips and ideas!

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

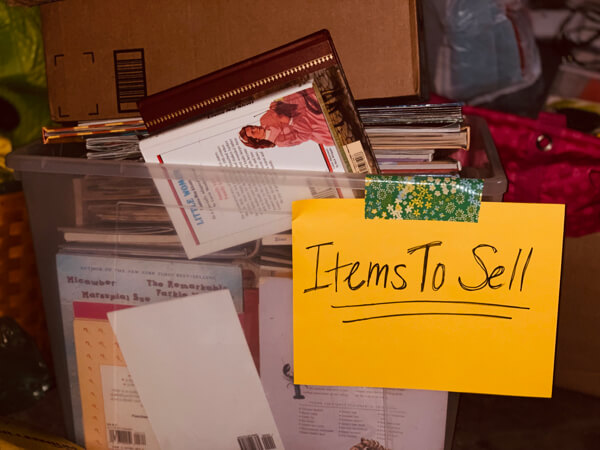

9. Clutter Buster Challenge

This one will not only help you save money, it will also help you clean up your house. A double bonus!

While this is not necessarily a “savings” challenge per se, it will definitely help with your mindset if one of your goals this new year is to de-clutter and/or keep things simple.

The goal of this challenge is to get rid of unused items in your house by selling one item for $10 every week for twelve whole months.

At the end of the year, you’ll have over $500 (plus, you’ll probably sell more than just one $10 item… it gets kinda contagious as you start to sell things)

If you stick with it, imagine how much you could make and or clear out!

Here’s what you ask yourself when deciding if you want to part with something. Ask yourself this:

Would you go out right NOW and buy it all over again?

If the answer is yes, hold on to it. If it’s a no, throw it in the sell pile.

Then have a yard sale or list things online in order to add more money to your Savings Jar.

Worried about selling items online? I’ve got a mini guide that’ll help you every step of the way. Get it free here.

10. Automate Instead

I know, I know… remembering to save your dimes, and clean our your purse each week, as well as setting aside every $5 bill can be hard to do when you’ve also gotta cook dinner, clean bathrooms and keep the kids alive.

Clarity Money will help you not only manage your money and your budget, but you can also set up an automatic savings account.

They will aso help you cancel your automatic subscriptions that you don’t use in order to help you save more money.

Empower is another online bank account that will help you save money. It can connect to your current bank account and will help you save more money by suggesting ways to save more money each month.

So there you have it, 10 simple ways you can save at least $500 (and up to $1,000) this year paying attention to your spare change.

That’s 10 consistent ways to save money during the year. They are also easier to implement than a typical 52 week challenge.

In fact, these are basically just “simpler” variations of the printable 52 Week Money Saving Challenge that are easier to complete.

The best part is you can get your family involved in saving money!

It’s time to print one of the challenges off and hang it on your fridge so you don’t forget about it and get busy collecting those pennies, dimes, quarters, dollars or $5 bills! Which one are you going to start first?

YOUR TURN: Which challenge are you going to do? Do you have another challenge idea? Comment below and let me know!

More Fun Articles To Read: