Shop TAX FREE for School Supplies!

Not all of us can be as lucky as those living in Alaska, Delaware, Montana, New Hampshire, and Oregon, where they have no sales tax. Most other states offer a Sales Tax Holiday the first weekend in August.

The Tax Exemption typically applies to individual Categories such as Clothing (including shoes), School Supplies and Personal Computers. Below I’ve listed each individual state’s limitations.

The Typical Stipulations:

- Clothing & Footwear – Any individual clothing items under $x ($100 in FL, other states listed below) are exempt from Sales Tax. Clothing refers to basically anything worn on the body such as clothes, jackets & hats. Even including shoes (even bowling shoes), bathing suits and backpacks. But not skates, roller blades, most sports equipment (including swim masks), watches or jewelry.

- School Supplies – Any individual school supply $x ($15 in FL, other states listed below) and under are exempt from Sales Tax. Most all school supplies qualify. The only ones that really do not are books, computer paper, correction tape/fluid and staplers.

- Computers & Accessories – This is the best one (if your state is honoring it). Any individual computer or accessory that is $X or less is exempt from Sales Tax. Includes printers, ink, all computer related items such as mouse, keyboards, zip drives, ear buds, tablets and personal computers! (not computer paper) On a $750 item, that will save you over $50!

TWO IMPORTANT NOTES:

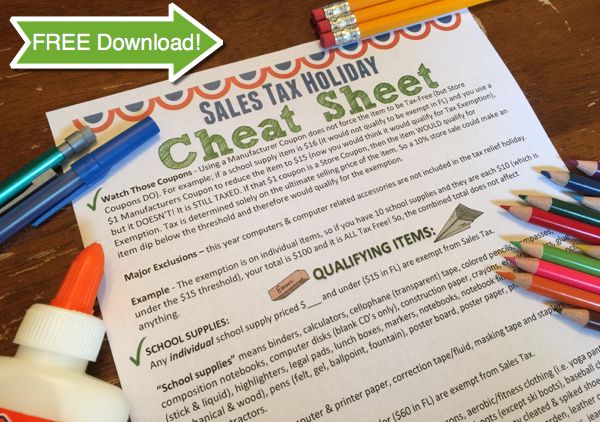

Watch Those Coupons – Using a Manufacturer Coupon does not force the item to be Tax-Free (but Store Coupons DO). For example; if a school supply item is $16 (it would not qualify to be exempt in FL) and you use a $1 Manufacturers Coupon to reduce the item to $15 (now you would think it would qualify for Tax Exemption), but it DOESN’T! It is STILL TAXED. If that $1 coupon is a Store Coupon, then the item WOULD qualify for Exemption. Tax is determined solely on the ultimate selling price of the item. So a 10% store sale could make an item dip below the threshold and therefore would qualify for the exemption.

An Example – The exemption is on individual items, so if you have 10 school supplies and they are each $10 (which is under the $15 threshold), your total is $100 and it is ALL Tax Free! So, the combined total does not affect anything. Yay!