Do you want to have more money this year?

Do you want to have more money this year?

One of the most flexible spending items we each have is our grocery budget. If you are willing to put in a little tiny bit of effort, and use cash, you can save $1,000 over the next three months by ONLY changing the way you look at your grocery bill. Watch how you spend and you will see that money quickly add up. The average family of four spends $175 per week on Food. If you cut that by only half and now spent $88 per week, you will have saved over $1,000 in 3 months. That is a nice chunk of change and that is only looking at one area of a budget: groceries!

Here are 7 of our easiest and most practical tips that you can quickly implement in order to save your own $1,000 this year!

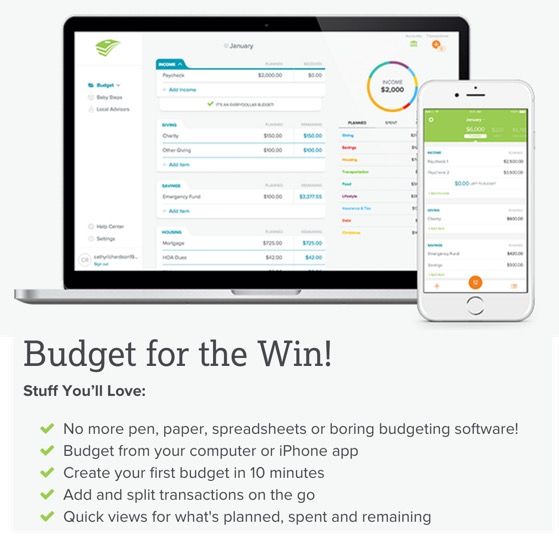

1. Tell Your Money Where To Go

Yep. This means you’re gonna have to start a budget. But this is not as daunting a task as it seems. Just look at what you have already been spending and decide where you want that money to go this year. Whatever doesn’t fit, is gone. Dave Ramsey.com has several FREE downloadable budgeting guides to help you understand how to quickly and easily form a doable budget. They also have a FREE App called “Every Dollar” to quickly help you create (and keep) a practical budget.

2. Use Sales AND Coupons

If you want to save big this year. You need to sign up for a Sunday Newspaper Subscription because the majority of the coupons I use come from the Newspaper. For the $2 you are going to spend each week, you will save at least $20. That is a no-brainer return on your money. But I don’t want you to buy just ONE paper, actually, I want you to buy TWO papers and then I want you to look at the coming grocery store sales flyers and use any coupons that match up with the current sale. This will save you around 70% off what you are currently spending. If it is not on sale, don’t buy it. Shopping from the sales will save you around 50% on your monthly bill. Adding coupons to that will save you more around that 70% mark. We’ve got several how to coupon videos to help you learn how to coupon when you don’t really have time, but still want to save loads of money.

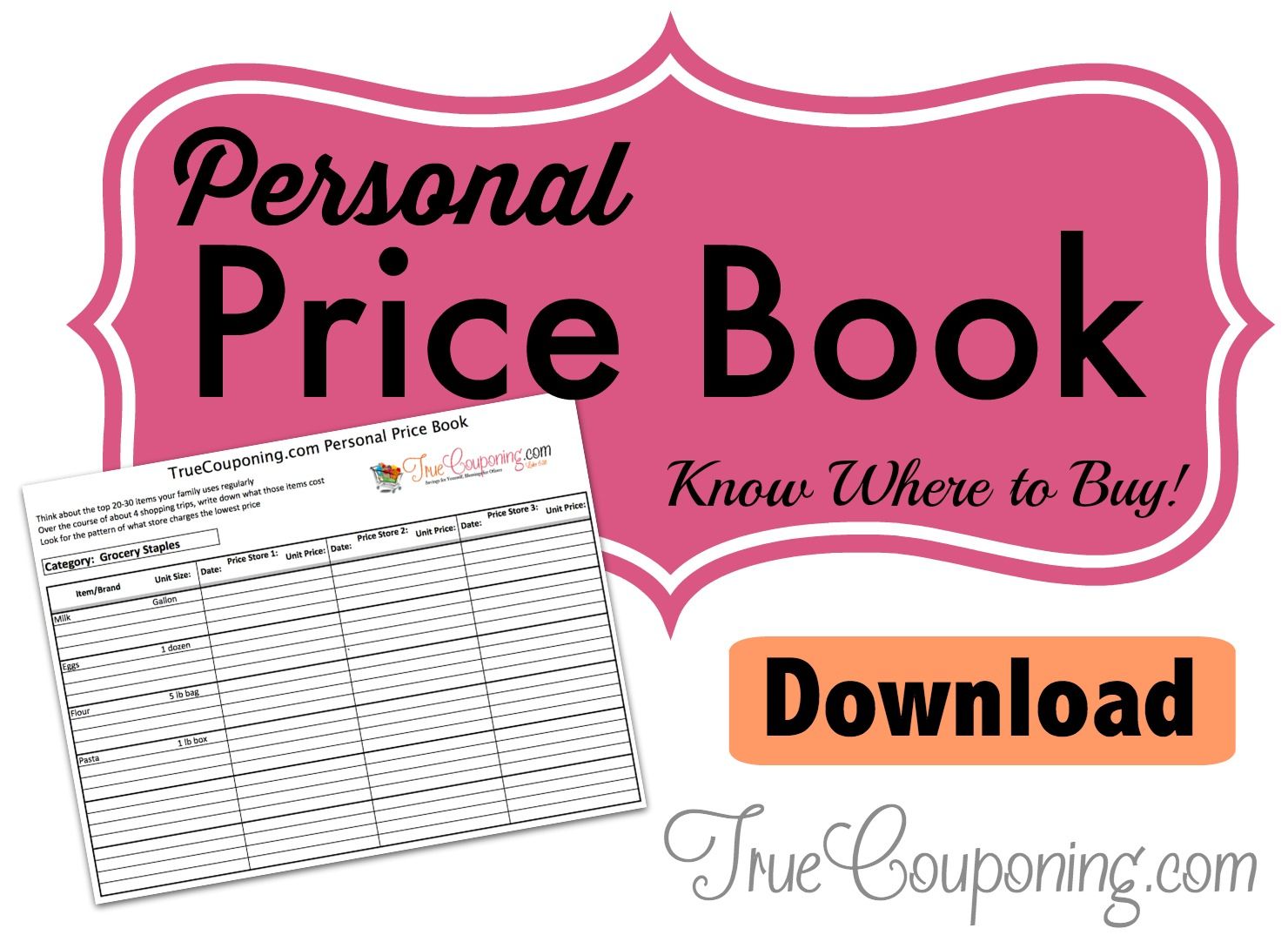

3. Create a Grocery Price Book

Did you know that you typically purchase the same 20 items for your pantry over and over again? If you took those 20 staples and wrote down what you pay for them each time you buy them (or if you are excited, next time you are at the store, write down how much their regular price is and then start documenting their sale prices), you will see a sale cycle develop and that will help you determine what the best SALE price is at your fave store.

But to take it even one step further… go look for those 20 items sale prices at another retailer. You might be surprised to find that without using ANY coupons, you might be spending more just because of when you buy items (you are buying them when you run out, instead of purchasing them when they are at the lowest sale price and stocking up). Switch Stores! By shopping at the store where it is priced the lowest, you will save more money! Your notes will tell you the exact number you should pay! We’ve got downloadable sheets to make it easy to track your families most purchased items and help you get your own Price Book completed in no time!

4. Know WHAT to Pay

4. Know WHAT to Pay

This is also called the Stock Up Price. It is the lowest price you should pay for something. It works along with your Price Guide because it is a “cheat sheet” of sorts to help you identify what you should pay… and then the Price Guide helps you identify where you will pay that lowest price on the items your family buys most. When you are shopping and purchasing items at the Stock Up Price, we suggest you buy enough to last your family enough to use up in 12 weeks. This is the average time it will take to come back on sale at the stock up price again)

Is it starting to make sense? Once your pantry is well stocked with items all bought at the lowest possible price, you won’t EVER pay full price for it again!

5. Track Your SAVINGS (FREE Download)

It is SO much fun to look back in a month or so and see how much money you are saving! Download our FREE Savings Tracker spreadsheet, just enter only 3 numbers found on your receipt, and the spreadsheet easily calculates your savings percentage per trip as well as how you are doing for the month and your remaining budget left to spend. This quick and easy tracker will help you see at a glance what you are spending (and therefore saving) in order to more easily stick to a budget!

6. Your Freezer is Your New BFF

Statistics show that we purchase too many veggies and fruits to eat before they go bad. Wasted food is waste money! Force yourself to think in ONE WEEK increments. That means when you get home from the grocery store, if you can’t eat it in a week…FREEZE IT. For some odd unknown reason, we tend to remember our freezer space and not over-spend in that area. When the perishables start to horn in there, you will spend less on all of it. Plus, you will start to cook out of your freezer which also saves money! (the money you’ve already spent)

7. No Kids Aloud

Yes, unfortunately, our very own sweet children can be a detriment to our budget. Until you are a seasoned couponer, and have invested hours of training time in your kids so they know we don’t buy something unless it is (1) On Sale AND (2) has a Coupon, you’re gonna need to trade baby sitting time with a friend or have your spouse put them to bed and leave about an hour before bedtime to give yourself time to shop without them. All those extra purchases that the kids talk you into…I promise it is more than you think. And once they taste that quick snack (pretzel combos for example) they will hound you for them again and again (at full price)! I shopped using coupons for years with my kids, so it can be done. Just be cautioned that they could be costing you more money.

~Happy New Year of Saving! You CAN do this!

Have another tip for readers about saving money without using coupons?

We’d love your feedback! Please leave a comment below and help out a friend!

You might also like:

Tips for Lowering Your Tips for Lowering YourElectric Bill |

FREE Online Coupon Classes FREE Online Coupon Classes |

Cinnamon Roll Waffles Cinnamon Roll Waffles Recipe |

Copyright © 2016 TrueCouponing.com Please do not cut & paste any information from here without asking us for permission first. Thank you!

Copyright © 2016 TrueCouponing.com Please do not cut & paste any information from here without asking us for permission first. Thank you!