It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

How To Cut Your Budget When There's Nothing Left To Cut

We've all been there before. Your credit card statement is staring you in the face and your checking account is just cents from zero. It happens. Time to make some household budget cuts. And then you get mad at yourself for allowing your finances...

The Best Weekend Girl's No Spend Activities You'll Love To Do

Whether you see each other every day or haven’t seen each other for months, having a weekend girl's get together with your girlfriends is a must no matter how busy you are. Just think about the idea of having your husband watch the kids for a...

How To Live On $2,000 Per Month

There are two types of people who want to live on $2,000 a month. There are the people who only have $2,000 a month, or there are those who want to live on less by living on $2,000 a month and saving the rest. I’ve been on both ends of the...

The Items You Are Forgetting To Include In Your Budget

When creating personal budget categories for your family, most people will start by either revisiting a previous budget they put together or by making a list of all their bills to figure out where money needs to be distributed. Budgets that are...

Reset Your Finances During This Month And Potentially Save $1,000 With The True Spending Freeze Challenge!

Have you ever tried a Spending Freeze Challenge, or even heard of no spending for a month? A Spending Freeze Challenge is exactly like it sounds; you set a period in which you don’t spend any money except for necessary expenses such as your bills....

Are These Poor Money Habits Making You Broke?

We are all guilty of certain bad money habits. In fact, I am willing to bet that even if you are the most frugal person in the world, you are still guilty of at least one bad money habit. For me, it was too easy to use our credit card. Over just a...

The Biggest Mistakes People Make When Budgeting

The idea of creating and sticking to a budget probably sounds pretty straightforward when you start the budgeting process. All you have to do is make a plan for where you want your money to go and then stick to it. Sounds pretty simple, right? But...

How To Continue Saving After Your Spending Freeze Is Over

Was the way of saving money with the Spending Freeze Challenge successful? Are you looking forward to the little extra money in your bank account at the end of the month? My desire to put the extra money to pay off debt turned into a vacation fund...

4 Sneaky Mistakes To Avoid When Trying To Get Out Of Debt

Paying off debt can be an incredible life changer. No more worry about having enough money at the end of the month. No more frustrating bills coming in the mail showing how much money you're spending on interest, and wasting, because you used...

AS SEEN ON:

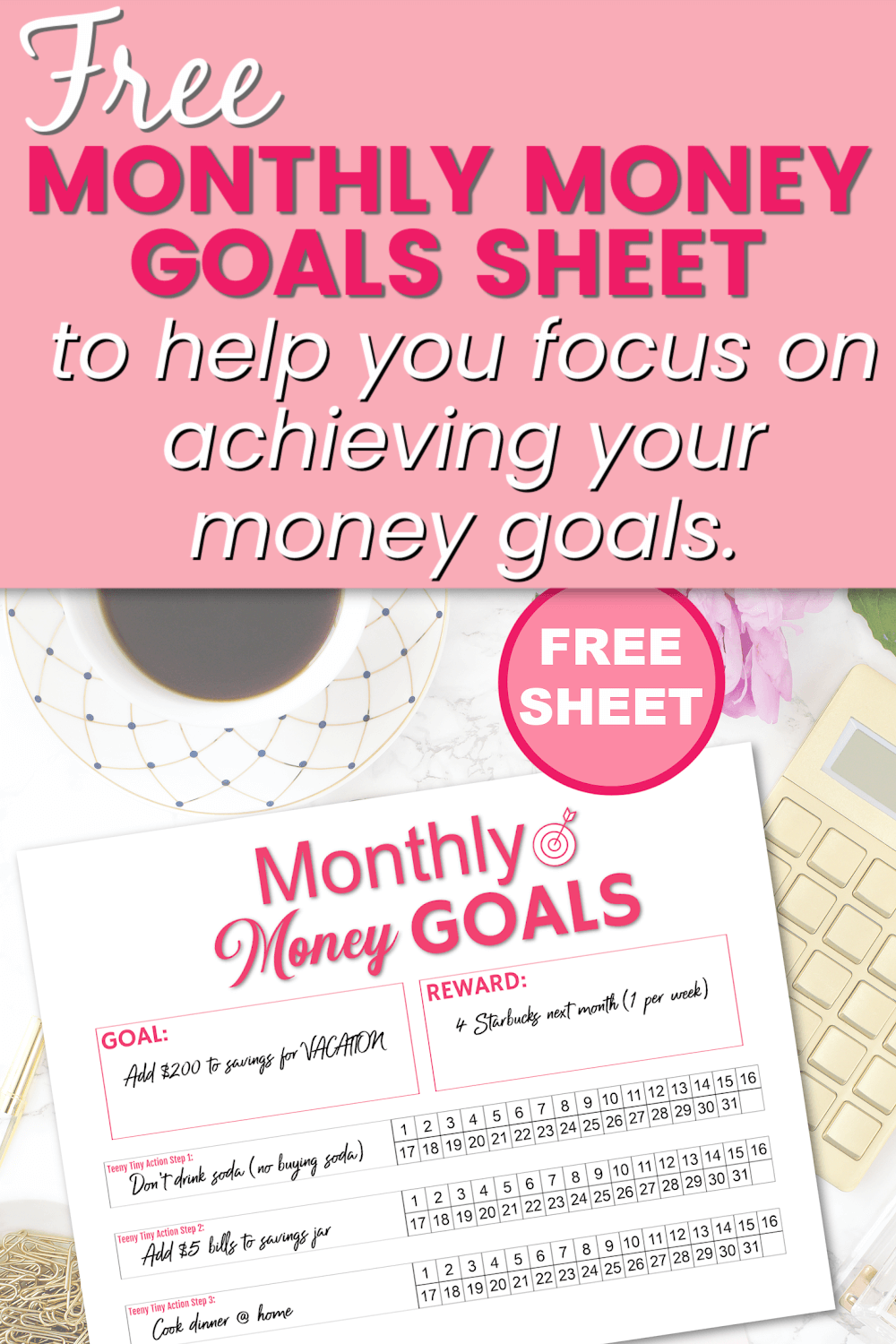

Where Can I Serve You First?

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

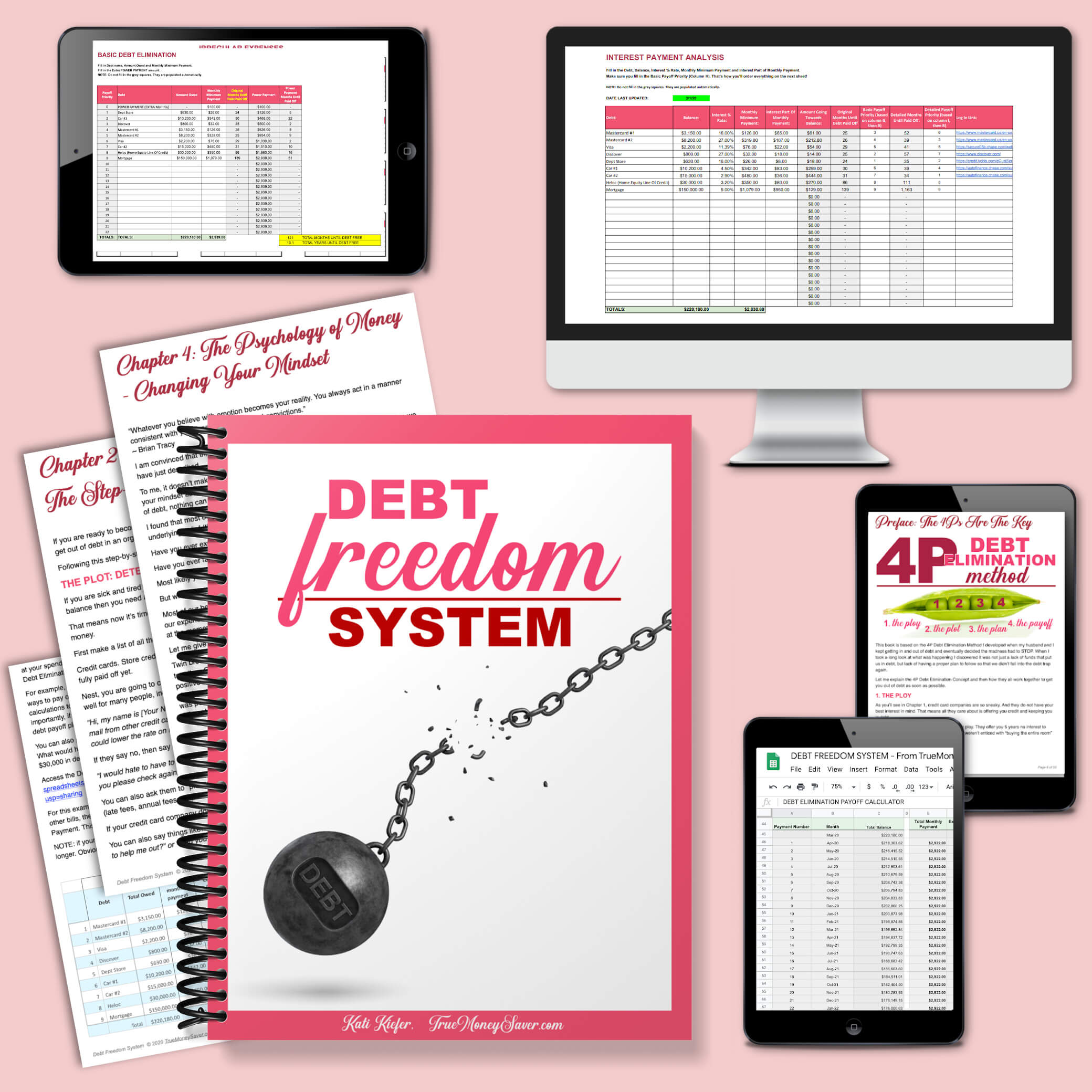

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Best Selling Products

JumpStart Your Savings

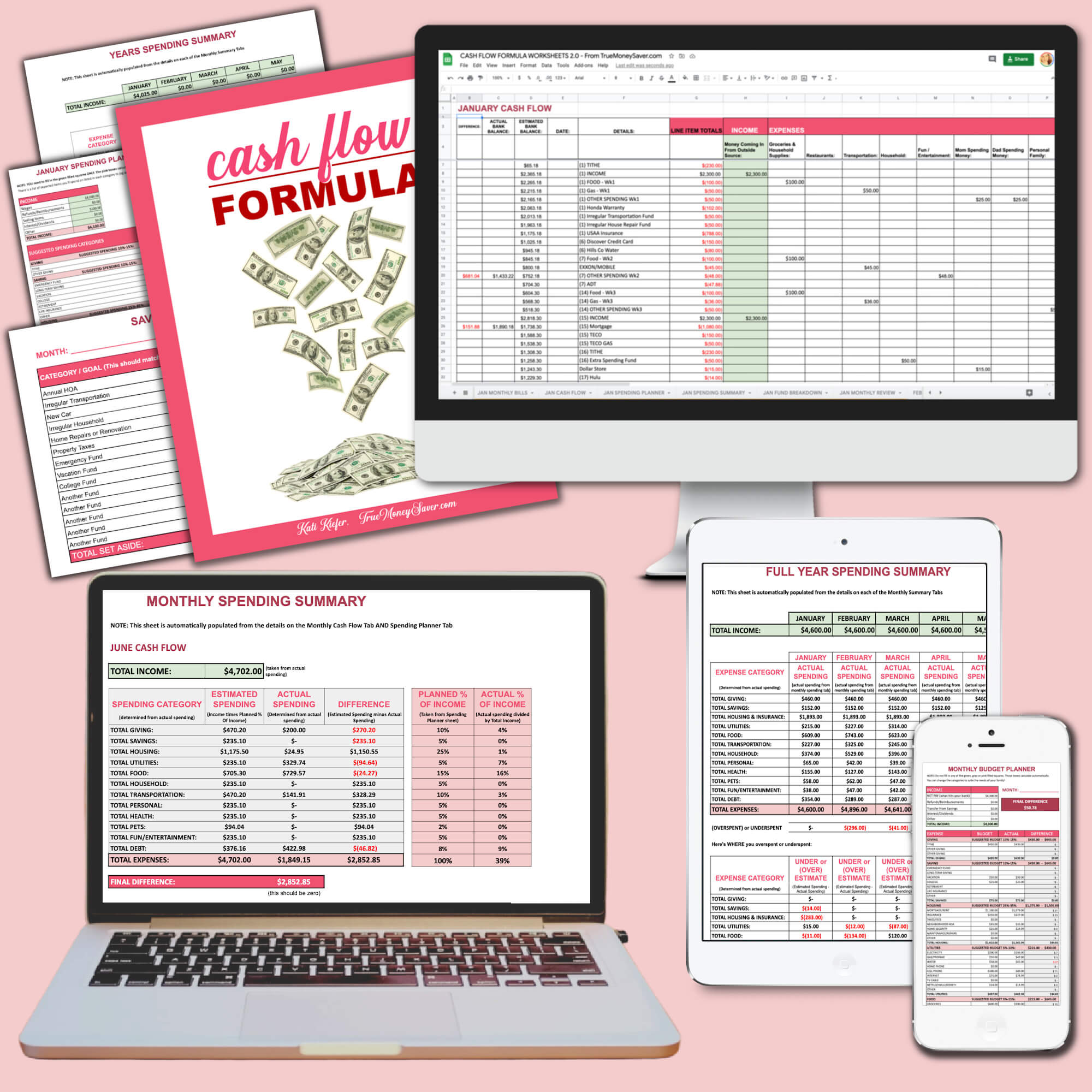

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)