It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

The Sweetest Nutter Butter Snowmen Cookies To Make This Season

Nutter Butter Snowmen Cookies If you can't bake you can still make these Nutter Butter Snowmen Cookies! You don't even need to turn your oven on to create these delicious cuties! Stop at the grocery store on your way home and pick up these...

The Cutest Milano Reindeer Cookies You Can Make Today

Milano Reindeer Cookies Skip the baking and enjoy the decorating by making these adorable Milano Reindeer Cookies. Start with premade cookies and end up with these cute reindeer in no time! Gather your ingredients. Assemble and decorate your MIlano...

The Greatest Eggnog Cookies You Can Make This Year

Eggnog Cookies If you love eggnog, you'll love these Eggnog Cookies! It's a new way to enjoy the flavor of eggnog this holiday season. You can also try this icing on cakes or cupcakes! Allow eggnog cookie dough to chill after mixing. Drop spoonfuls...

The Best M&M Christmas Cake Mix Cookies For Easy Treats

Christmas Cake Mix Cookies If you've got a cake mix in your pantry, you can whip up some cake mix cookies in no time! These cookies only take 4 ingredients to make these! Mix in red and green M&Ms for Christmas. These could easily be adapted...

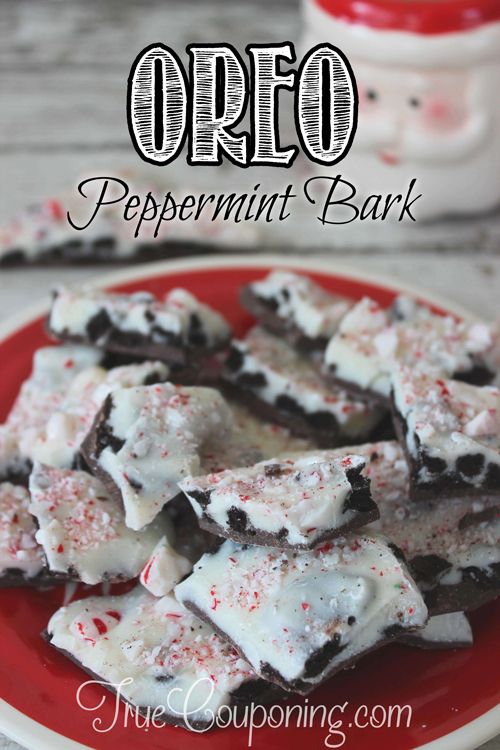

The Best Oreo Peppermint Bark Recipe You'll Love To Give

Oreo Peppermint Bark Recipe The combination of chocolate and peppermint is irresistible in this Oreo Peppermint Bark Recipe. This bark is delicious and pretty, isn't it? You'll need just a few ingredients. Use a food processor to crush up some...

How To Pay Your Bills When You Have No Income

{This post is sponsored by Diamond Bloggers, the story and opinion is 100% my own.} Have you experienced a time when you had no income coming in, and no savings to fall back on, yet you still have bills to pay? The problem is that when you have no...

Are Debt Reduction Services A Good Solution To Pay Off Debt?

{This post is sponsored by Diamond Bloggers, the story and opinion is 100% my own.} When James and I first got married in 1998, he was working as a manager at McDonald's and I had just graduated from college with my accounting degree and I was...

Surprising Facts You Need to Know About Your Credit Report

The credit report. Just hearing those two little words is enough send some consumers into a state of elevated anxiety. What's worse - it's an involuntary reaction, it just happens! Even the best consumer out there with a perfect credit...

The BEST Cheeseball Recipe…EVER!

Peanut Butter Cheeseball Recipe Want a quick and easy recipe to take to those Super Bowl / Summertime / Anytime parties that is a little different but oh, so delicious? Check this out!!! You're just six simple ingredients away from a different and...

AS SEEN ON:

Where Can I Serve You First?

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

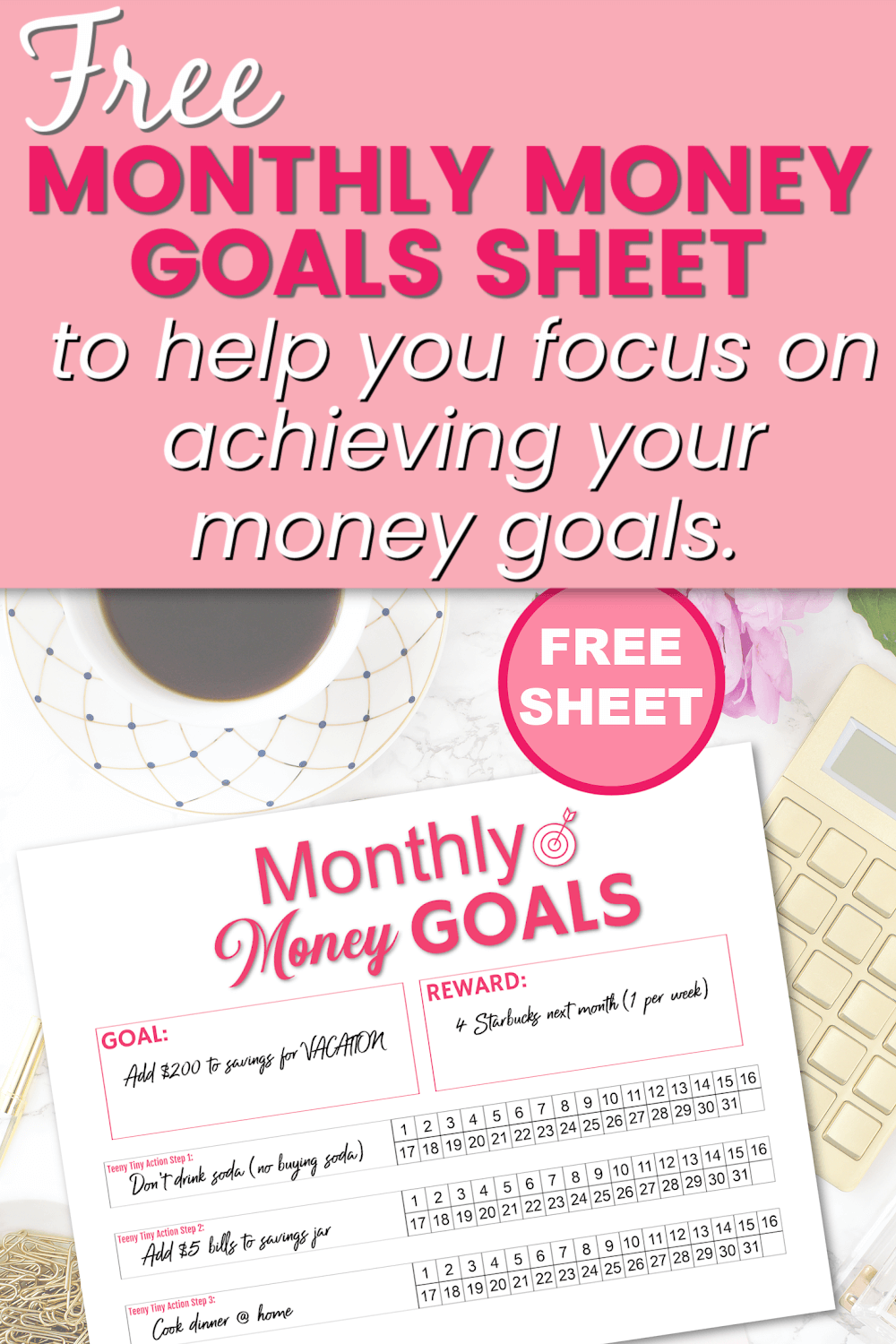

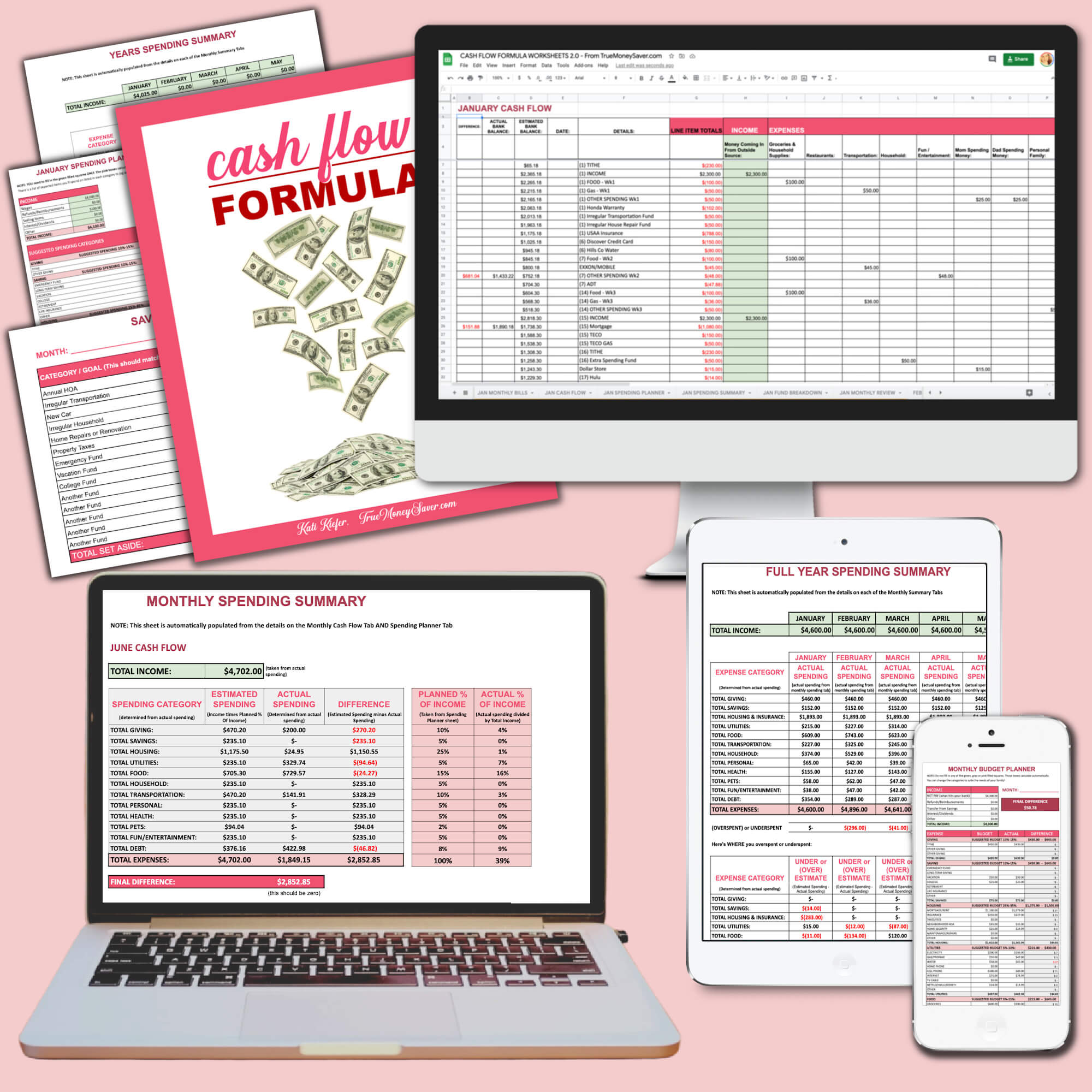

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

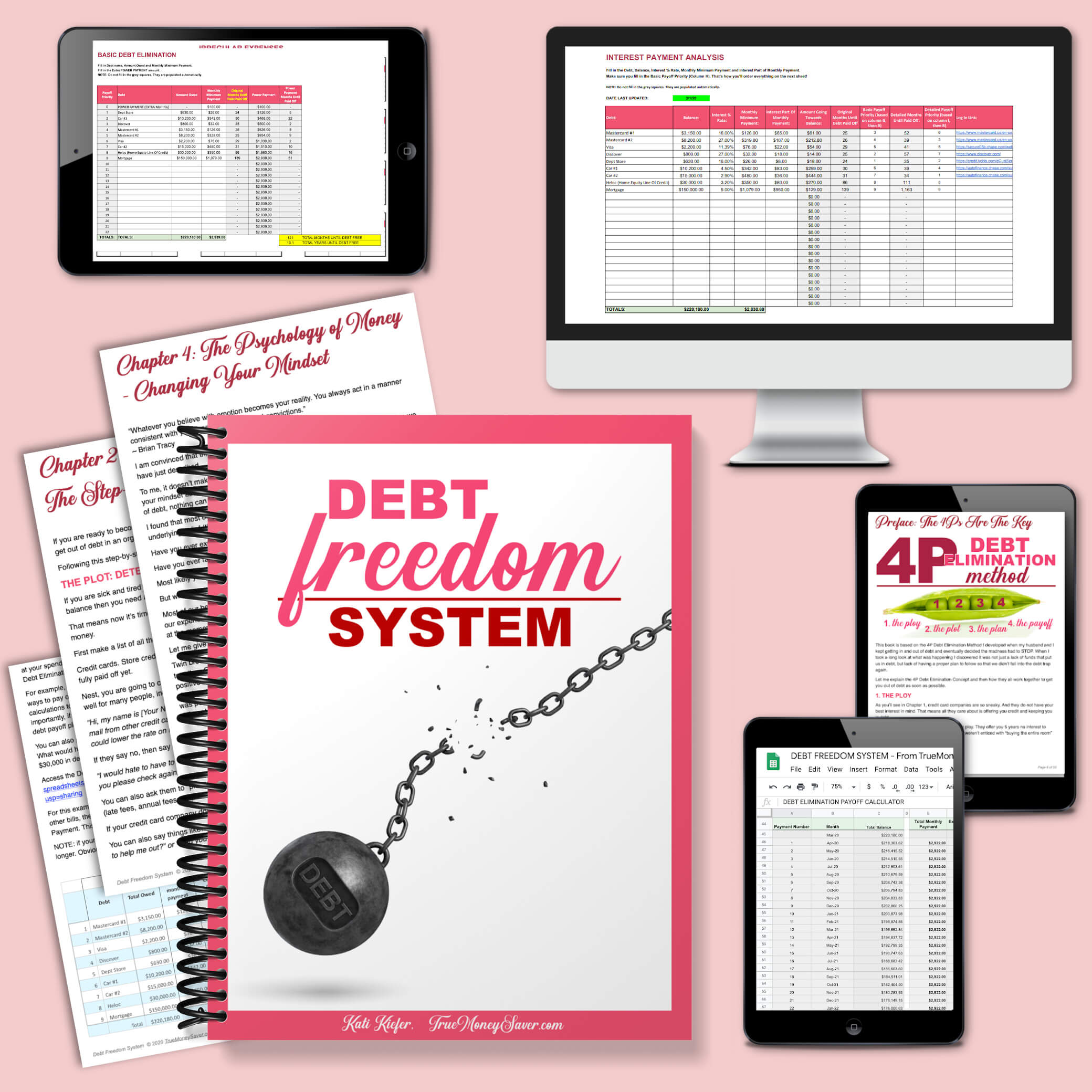

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Best Selling Products

JumpStart Your Savings

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)