It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

The Most Helpful List Of Household Expenses We Will Never Cut

If you're looking at your list of household expenses and trying to decide what to cut, let me stop you there! You can't cut everything out of your budget, although we all wish we could at some point in our lives. This past year has been a doozy,...

How To Find The Best Free Family Entertainment During Your Spending Freeze

Looking for family entertainment that doesn't cost a lot? We talk about many different ways to save money and get the best deals on TrueMoneySaver, but one of the best ways to save your money is by not spending it! A few years back when we were...

How To Create A Tight Budget To Build Your Savings

If you are tight on money, then you are learning how to live on a tight budget. But, it's so important to put money away for savings regularly. Having money in a savings account will provide you with a cushion for emergencies and unexpected...

How To Make Your Spending Freeze Budget for Groceries Stretch

We’ve all faced this scenario at least once: It’s the middle of the month, your budget for groceries is completely spent, and your cupboards are starting to look a little bare. Whether you’re in the middle of a spending freeze, or you just need to...

The 4 Different Types Of Budgeting You Need To Try

Did you know there are different types of budgeting? There is. And since there is no right or wrong answer when it comes to how you budget your money, neither is one type of budgeting. Some methods may work better for you than others, but as long...

The Best Free Fun Family Activities To Do On A No Spend Weekend

If you have a family, I'm sure you are looking for free fun family activities to do every now and then, especially when you are trying to save money and not spend it. One of the most common reasons why people choose not to do a spending freeze is...

How To Plan Your Best Financial Year Ever

It’s a new year and a fresh start! If your New Year’s resolution this year is to make better money management decisions or even give your finances a financial makeover, you’re in the right place! I’m going to show you how to plan for your best financial year yet!

How No Spending Month Challenges Can Reduce Stress

Do you need to know how to spend no money this month? A no spending month might sound like more hassle than it’s worth. If you have a difficult time controlling your spending, a no spend month challenge might sound like setting yourself up to fail....

How To Afford Travel Even When You’re In Debt

Have you looked at your budget and can't find the money for travel expenses? You may be looking at your budget now and feel like all your money is going toward paying bills. Sure paying your mortgage, student loans, car loans, and credit cards are...

AS SEEN ON:

Where Can I Serve You First?

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

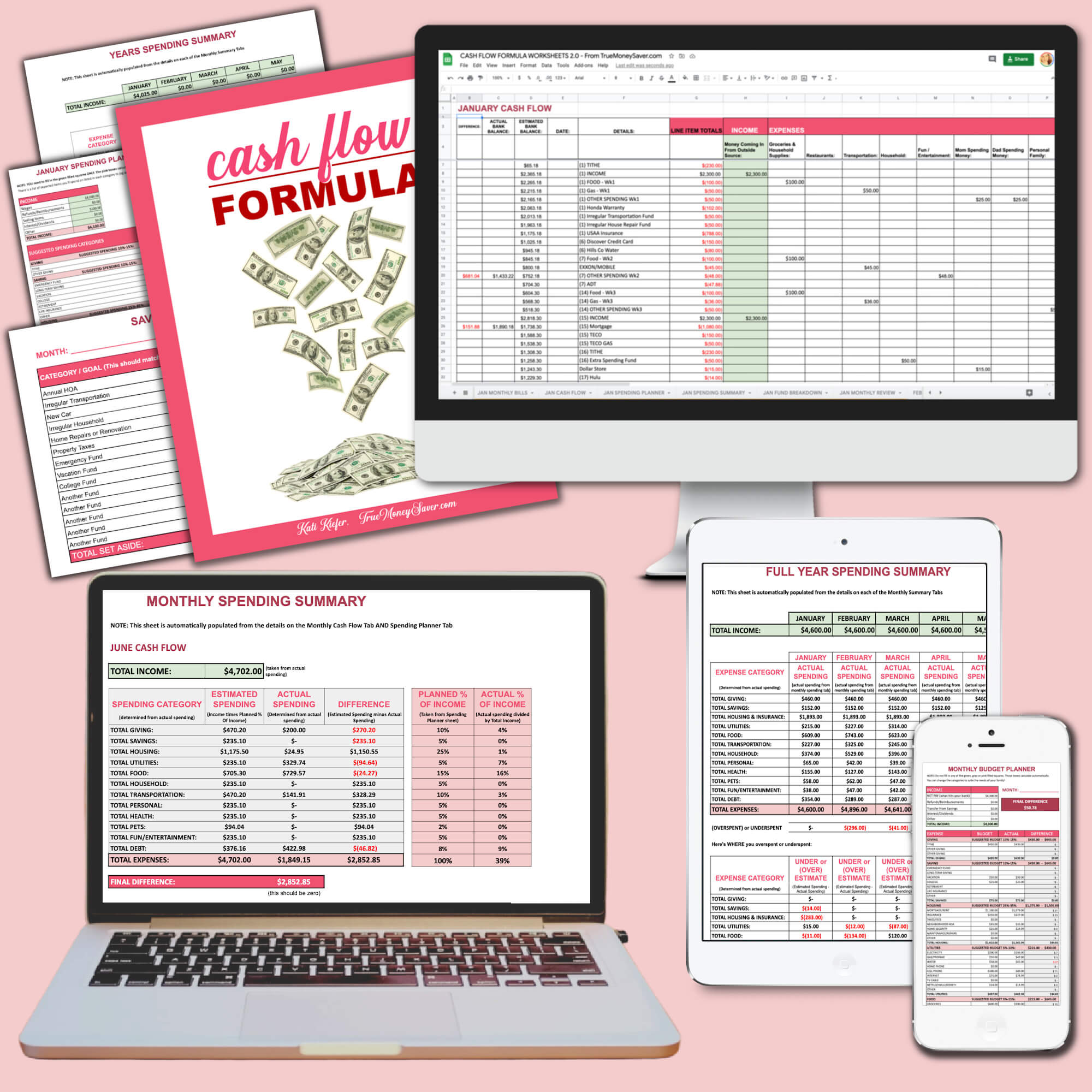

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

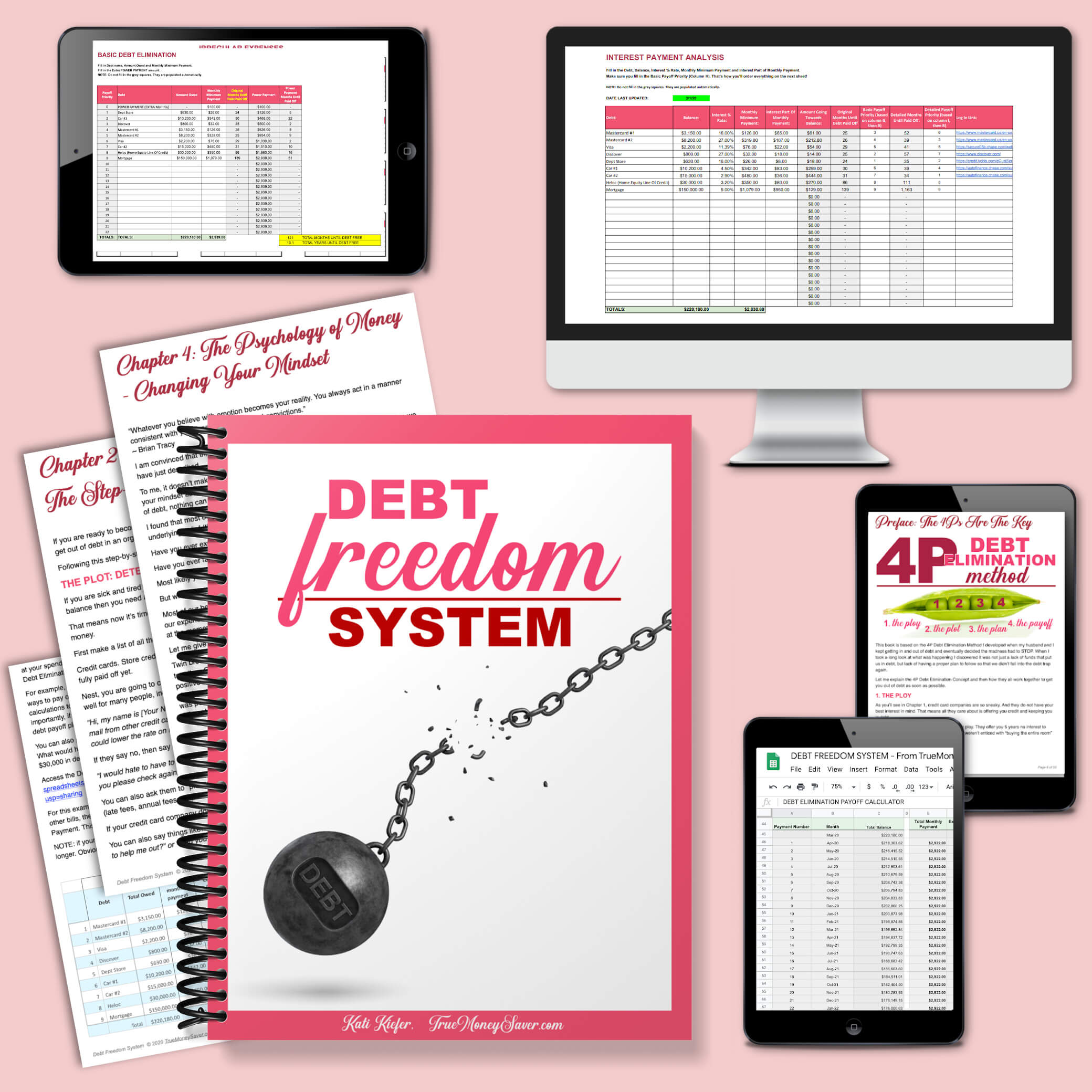

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

How To Make The Most Affordable Foaming Natural Soap For Hands

12 hands that need washing several times a day requires some kind of natural soap. I'm a couponer, but I was so tired of trying to find the latest deal on a natural soap. Trying to figure out if I had the coupons or not and how many I could...

My mobile and super cheap “office”

I get asked all the time how (and where) I run my business from my busy home. We have 4 kids who each have their own bedrooms and we are constantly hosting people who want to visit Florida when things get cold in "their neck of the woods." You...

How To Get Bath & Body Works Coupons For FREE Products

Ah, there's nothing like the glorious scent of a Bath & Body Works fresh fragrances or the soft, soothing skin care that glides seamlessly over your skin to make it beautiful. I've got boys... so I keep some fragrances right in the pocket of my...

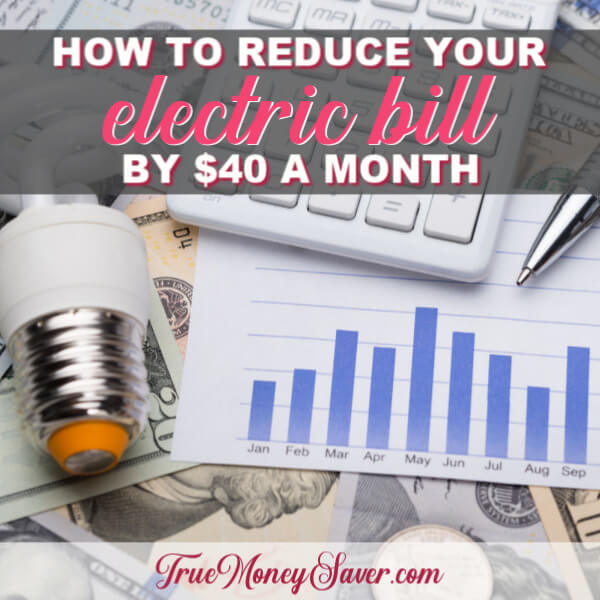

How To Save $40 A Month Off Your Electric Bill Without Raising The Thermostat

The electric bill. Next to your mortgage and car payment this is likely one of your largest monthly expenses. Did you know that the average household spends over $2,000 a year on our Electric Bills?! That's a lot of money! And since I live in...

Best Selling Products

JumpStart Your Savings

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)