It’s time to stop stressing out about money.

Heyyyy Friend, I’m Kati. I’m on a mission to help you spend LESS on your necessary expenses so that you have MORE to spend on fun things, like vacations (and sassy shoes… and Coach purses!).

Let me teach you how to spend smarter and manage your money better so that you can live a life of abundance.

FROM THE BLOG:

How To Make A DIY Pom Pom Fleece Blanket Gift

Have you ever received a DIY Pom Pom Fleece Blanket? I've received several and there's nothing like receiving such a warm and cozy gift. So why wouldn't you want to give such a warm and cozy gift too? Well I've come up with a way to make an easy no...

How To Make Homemade Stainless Steel Cleaner In Just Minutes

It was cleaning day and I ran out. I simply ran out of stainless steel cleaner and polish and I didn't want to run to the store again. I was going to have to make my own homemade stainless steel cleaner and polish if I was going to get my cleaning...

How To Make Handmade Traveler's Notebooks For Great Gifts

With all the traveling my friends and family do, I knew I needed to make some handmade traveler's notebooks for them for gifts. I have made a simple travel notebook before, and I loved the way they turned out. It's so much fun to add all of the...

The Best Personalized Jewelry Box You Can Make This Year

I've always loved a personalized jewelry box ever since I was little. I was given one when I was little and I had it for the longest time. But what makes a personalized jewelry box so special? The thought that it was handmade and painted just for...

How To Make A Floor Cleaner For Super Clean Floors

Does your laminate floor cleaner work well? The floors throughout my entire house look like wood, but they are actually a laminate. I love them because they are so strong. They don't show scratches and they are easy to clean. You know that I am a...

How To No-Sew The Best Heating Pad For Great Gifts

What makes the best heating pad? Besides one that works, one that is handmade, of course! I still have several my grandmother made me a long time ago. Not only do they still work great, but they are a great memory of my lovely grandmother each time...

How To Make Surprisingly Easy Tea Light Holders

Don't you just love the light that comes from tea light holders? Candlelight is magical. But getting a candle as a gift makes it even more special - especially one like this that keeps on giving! These DIY holders are such a great gift. Not only...

How To Clean Your Stainless Steel Sink And Not Spend A Fortune

If you need to learn how to clean stainless steel sink in a cost effective manner, you're in for a treat! For the last three years I've asked for one thing for Christmas: a new kitchen sink. My husband thought that was a horrible gift to buy me,...

How To Treat Yourself Without Spending A Dime

Being a mom means it's hard to take time to treat or spoil yourself. Between keeping up with the kid's school stuff and sporting functions, keeping your home semi-neat, running errands, cooking meals, and maybe (especially in my case) running a...

AS SEEN ON:

Where Can I Serve You First?

At True Money Saver, my goal is to immediately help you save money (by reducing your food costs), then I’ll get you on track to better manage your money (by setting up a realistic budget), and then you’ll learn how to take those savings even deeper (by saving on EVERYthing you buy) so that you can live in abundance (and pay off any debt).

Grocery Savings

“Groceries” are not just the food you buy. It should include EVERYTHING you purchase at the grocery store (or Walmart/Target). That includes cleaning supplies, paper products, health & beauty items, and of course your food, too. There are simple ways to save on all of it (without using coupons, or sacrificing quality).

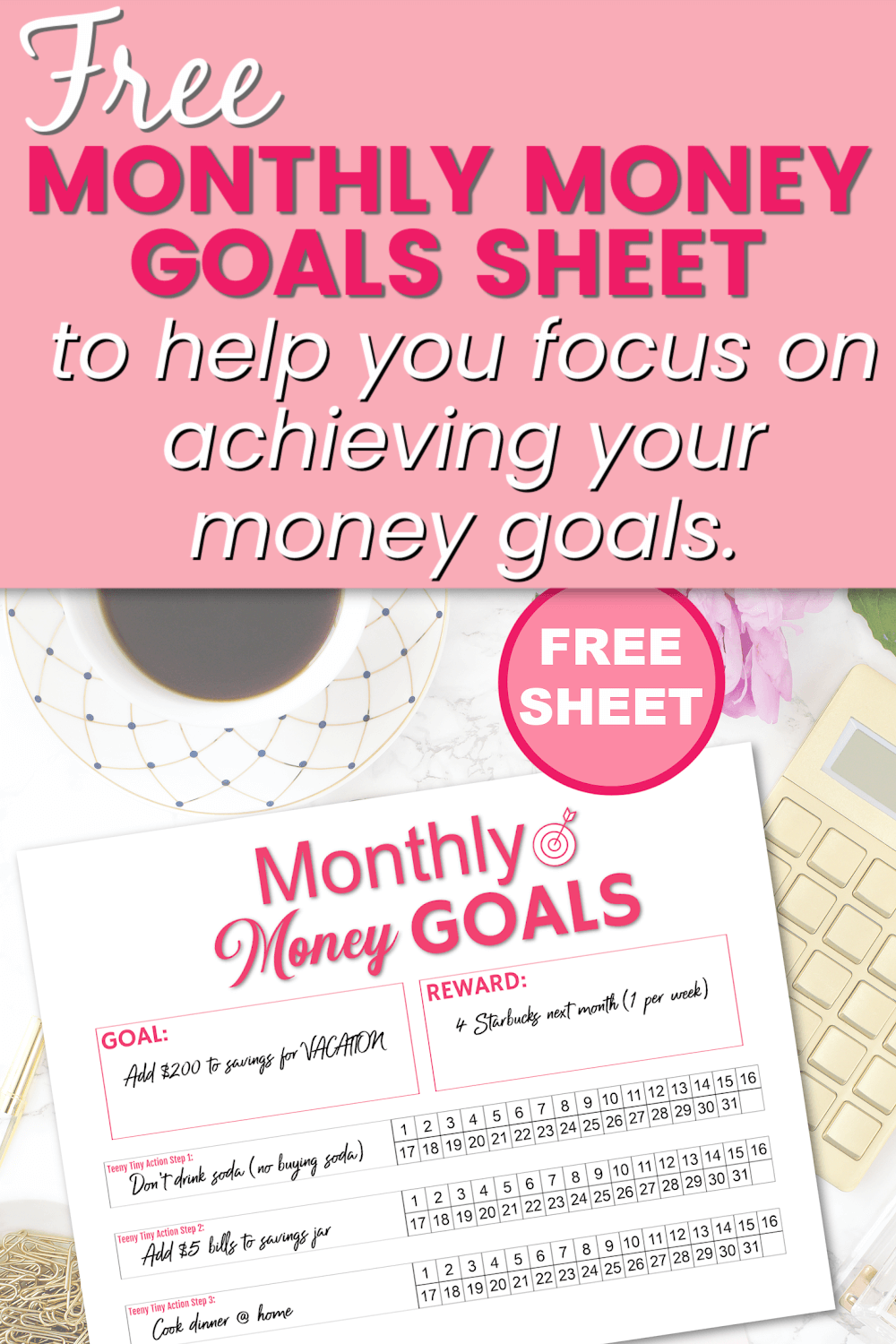

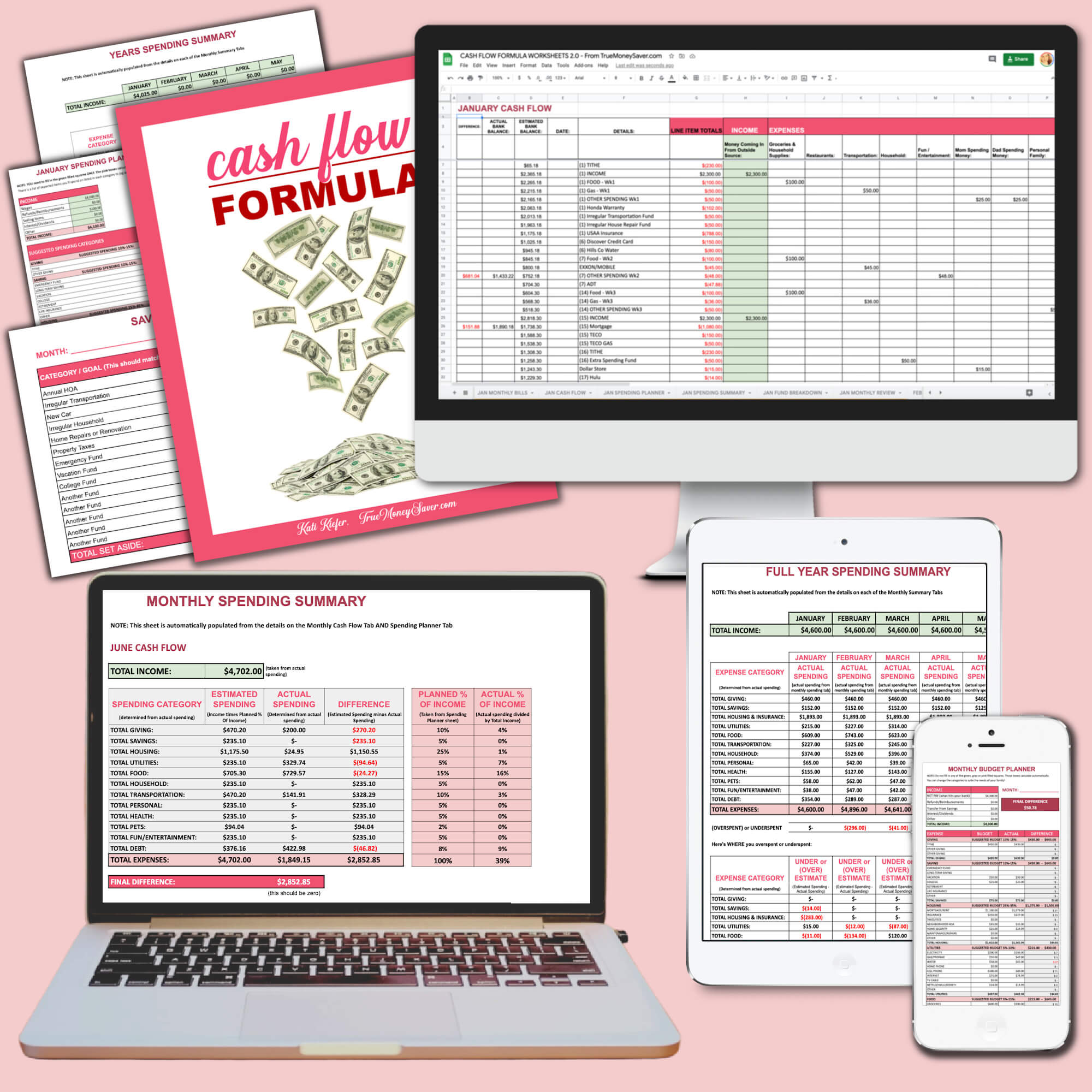

Managing Money

This is when things get fun. It’s time to take advantage of the “low hanging fruit” by reducing spending on every single thing you buy… this is beyond the grocery store. Ways to save on Starbucks, movie tickets, household appliances, a vacation to Disney, and even a new car. Managing your money is the key to have more of it.

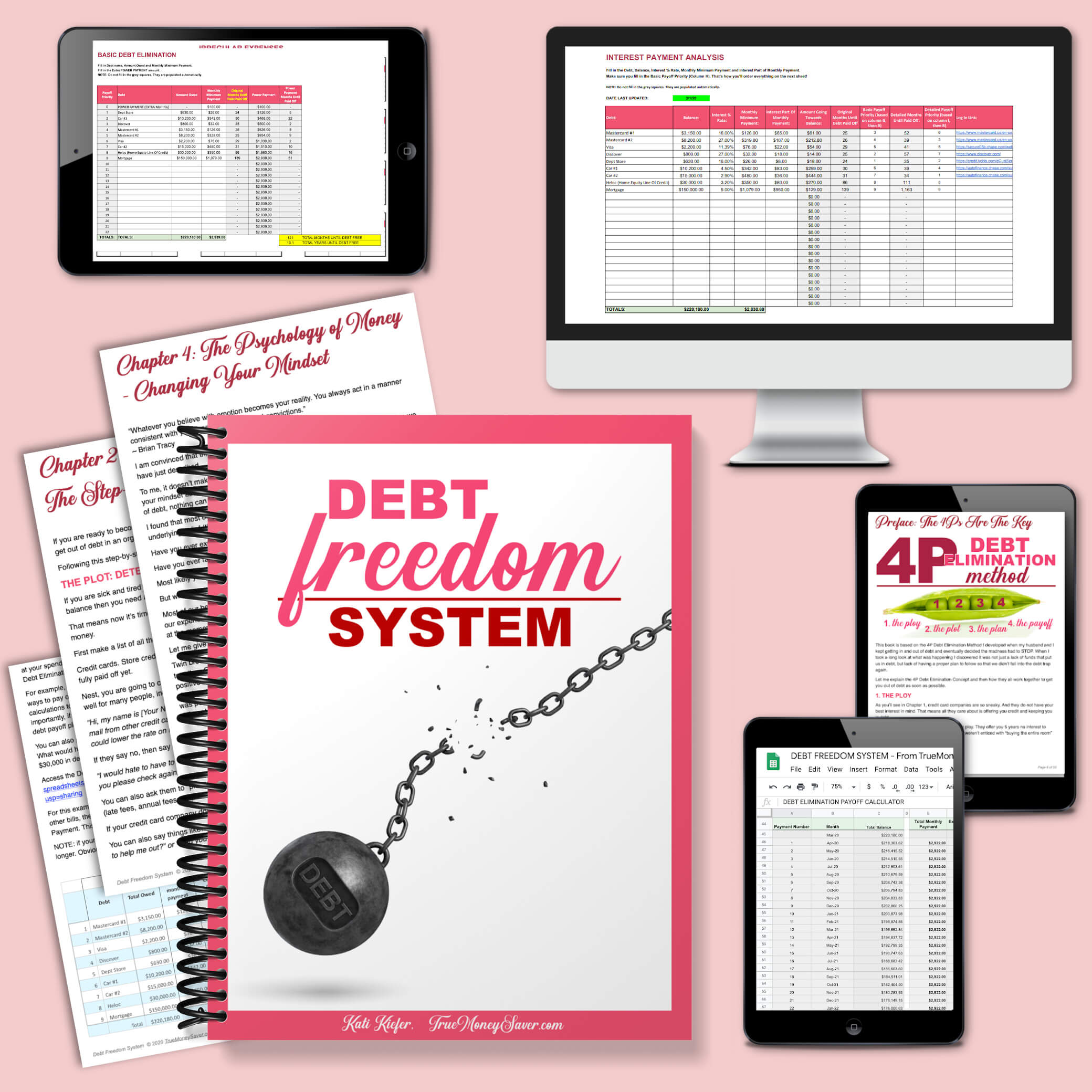

Debt Success

Once you know the strategies to save on your expenses, and you’re successfully managing your money, now it’s time to dig deeper and conquer the debt. It doesn’t matter if it’s student loans, credit cards, cars, or your mortgage. We’re gonna defeat it once and for all, and make sure it NEVER comes back.

READER FAVORITES

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Best Selling Products

JumpStart Your Savings

The Cash Flow Formula

We’d make great friends!

I help busy, over-exhausted moms, maximize their money so they can pay off debt and take fun family vacations without feeling guilty (or using credit cards). In three years my husband and I were able to pay off over $15,000 of consumer debt despite being a homeschool family living on one income. Before the pandemic, we took our family of 6 to Disney World every month… just because we want to make memories with them. (They grow up far too quickly!!)