Every year, just like clockwork, April 15 rolls around and with that spot on the calendar comes the deadline for filing income taxes.

Every year, just like clockwork, April 15 rolls around and with that spot on the calendar comes the deadline for filing income taxes.

If we listen really hard we could almost hear Uncle Sam yelling “Ready or not, here I come“!

To help you get that IRS tax refund faster, there are 5 easily fixable mistakes that result in delayed or possibly denied refunds, or worse, penalties & fines.

After all, steering clear of tax mistakes is the name of the game when it comes to filing for your IRS tax refund.

Don’t let your money go unclaimed, and make sure you get the most back by avoiding these 5 IRS tax refund common mistakes.

I spoke about this topic on my Savings Segment on Fox TV. Watch the replay video here:

1. Double Check Your Personal “Numbers”

Even if you file electronically, the online program has to use the numbers entered, even if they are entered incorrectly!

The most often information that is missed or entered incorrectly is:

- Social security numbers either incorrectly entered or missing altogether

- Incorrect spelling of names

- Using the wrong filing status

- Incomplete income information (discussed in more detail in the next point)

- Can you guess the biggie? Incorrect bank account information!

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

Before clicking the “file now” button, employ the “buddy system” by reading these most important numbers aloud while your buddy verifies their accuracy – TWICE!

Can you imagine going through the entire tax filing process to have your refund withheld or worse: deposited to a stranger’s account because of incorrect information? Yikes!

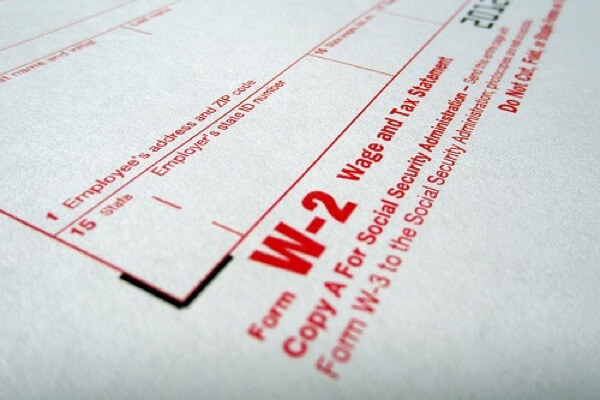

2. Missing W2’s & 1099’s

The W2 and 1099 forms are your official income statements for the year.

If you earned any money, in most cases a W2 or 1099 form is required to be filed with the IRS by the employer, and then reported by the earner (that’s you!).

If you changed jobs during the year or work more than one job, you will end up with multiple forms.

You have to include all of them in your return.

What if you know you should receive one of these forms and haven’t? The IRS can help.

Employer’s are required to send out (via email or snail mail, or both) the W2 and 1099 forms by January 31st, if you have not received your form(s) by February 15, here’s what to do:

Call The IRS At 800-829-1040

This is pretty neat. The IRS will send a letter to your employer on your behalf requesting the W2 or 1099 so that you don’t have to.

You need to be sure to have this specific information before you call.

Not having the right information will cause another delay.

File On Time Even Without Your W2’s And 1099’s (Or File An Extension)

Yep, you read it right! The IRS recommends to estimate your wages and earnings as much as possible and go ahead and file on time.

I don’t know about you, but that’s a little bit scary to me and certainly spells out F-O-L-L-O-W -UP- R-E-Q-U-I-R-E-D!

When it comes to our money playing the guessing game is just simply uncomfortable.

A safe alternative is to get an IRS transcript. This is the document where all your tax information is kept each year, INCLUDING the amounts employers paid to you. If you have to file without your official forms W2 and 1099, using this data is a safe alternative.

Don’t forget there is the option of getting an extension if you just can’t file on time (but remember, you STILL have to file for the extension on time). You can read more on that topic here.

When To File A Corrected Return

If you discover that your return contained an error you might need to file a corrected tax return, these are called an Amended Return.

However, in some cases, the IRS will correct minor things so you might not need to file an amendment.

The IRS will correct simple math mistakes and notify you of the changes.

However, you do need to file an amended return if there is a change in your:

- Filing Status (married, married filing jointly etc)

- Income (maybe you reported the wrong amount initially)

- Deductions

- Credits

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

You’re going to need a form called the 1040X which is designed specifically for filing tax mistakes.

The 1040X form is available at www.IRS.gov or by calling 800-TAX-FORM (800-829-3676).

You can even check the status of your amended return. The great news is you will indeed get your refund! The downside is that more time will lapse while straightening out mistakes.

3. Avoid Math Mistakes

Every year tons of returns are filed containing miscalculations in math.

It’s so easy to transpose numbers. Who hasn’t done that before?

Electronic tax software contains built-in calculators that help eliminate these issues. However, we still have to enter the the initial data correctly. Whatever we enter is what the software has to work with, so be careful and don’t forget the buddy system.

We recommend having a coupon buddy to help avoid common coupon mistakes; the same principle applies here.

Claim The Correct Deductions

Some of the top mistakes made in claiming tax deductions are found in the credits for earned income, child care credits and erroneously claiming deductions that you are not entirely qualified for.

With today’s trend of so many of us telecommuting and working from home, another popular deduction that is sometimes misreported is the deduction for home office or the deduction for charitable donations and the issue of the tithing.

Our friends over at Dave Ramsey recommend taking the deduction as doing so does not diminish the sanctity of the tithe, and is in fact being the good manager God desires.

Whew! Donations, expenses, credits, deductions, extensions! This may be starting to sound like an advertisement for the IRS, but in reality it’s the best resource for answers and they have a ton of those. We found a tool to help you do your homework and see what’s deductible and what’s not. Wa-HOO!

Take a look at some IRS resources about home office and other deductions for individual filers (that’s us)!

Keep Receipts

Once you know what you can deduct, it is important to be able to verify the expense. How do you do that?

You guessed it receipts! Keep them all!

They are your single best protection in the event of an audit. Arguing with the IRS won’t help a thing. Receipts are evidence of your claim.

Here’s How To Organize Your Receipts

While the ole’ shoebox or shopping bag trick may be dandy for some, experts recommend taking it just a wee bit farther than that.

- The folks over at TurboTax say a good place to begin is by writing on each receipt immediately when you incur a valid expense and placing it in an appropriately labeled envelope.

- Another option is to write on the receipt and take a photo of it. Developing this habit takes only moments out of the day and will soon stop feeling like a chore.

Then, follow it up with regular dedication to transferring the data into either a spreadsheet or financial software, perhaps monthly at bill paying time.

If you are the geeky type, there are also some online (or Smartphone App) options that offer free digital storage for scanning and keeping receipts such as SmartReceipts or Wally.

Whatever your preference, once you get started you’ll be in the habit before you know it and tax prep will be a breeze.

If you can’t fathom going back through all your receipts for last yer, start this practice in place for next year!

One more word about keeping receipts ~

A Budget Is The Easiest Way

The best way to keep track of your spending is to simply pay attention to it.

And that is truly just using a budget. Even if all you do is track where your money went (as opposed to managing how you want to spend it beforehand) you’ll be WAY better off at tax time for getting your IRS tax refund.

4. Sign Your Forms

Have you ever paid a bill with a check only to have the lender call you up or return an unsigned check AND a late notice? Frowny face!

Happily, online bill pay erases that one potential for error for many of us.

However, when on the subject of filing a tax return they must all be signed, yes, even the electronic returns have to be signed. Which means you have to spell your name correctly (check and double check!)

This is one signature you do not want to miss as it will certainly lead to a delayed return and even a penalty!

Many tax software companies take the hassle out as they won’t let you proceed to the e-file step without it, but you may want to read these up-to-date instructions from good ole’ Uncle Sam to help you avoid this common tax filing mistake if it’s an issue you encounter.

5. Free Tax Software

Why pay when it’s free? Many top e-filing services have tax filing software that will help with your IRS tax refund.

The top 3 I have used before and trust are:

Another neat program that includes FREE tax software is the Volunteer Income Tax Assistance (VITA) program.

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

IRS-certified volunteers provide free basic income tax return preparation with electronic filing to help to people who generally make $55,000 or less, or people with disabilities or limited English speaking taxpayers who need assistance in preparing their own tax returns.

In addition to VITA, if you are over 60 years of age the Tax Counseling for the Elderly (TCE) program offers free tax help specializing in questions about pensions and retirement-related issues unique to seniors. These IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

You may also be interested to learn about VITA and other programs who provide free tax preparation for service members here or even how to donate your expired coupons to the military.

Bonus: Pay Yourself Instead of Uncle Sam

One year we estimated that we were going to have to pay on our taxes.

A tax accountant told us if we donated to OUR OWN IRA (which has a deadline of April 15th of the year AFTER you are filing), it would reduce our income enough to not pay anything.

Ultimately, instead of giving more tax money to the government, we were able to contribute to our own retirement.

The reason why that worked is because an IRA savings account delays having to pay tax on that money. As a young, newly established family, just starting out, we needed that delay!

So learn from my experience and at least look into it. You might find a similar solution to pay yourself and save money too!

There you have it straight from the horse’s mouth, how to beat the Top 5 tax filing mistakes and get your refund faster!

YOUR TURN: What are some simple tax filing mistakes you have made to cause a delay in your return? I’d love to hear from you. Comment Below!

More Fun Articles To Read:

The Best Way To Save Money For A Vacation Is By Cutting Expenses

Looking for the best way to save money for a vacation? Summer vacation might feel like a distant dream, but before you know it, your kids will be out of school and on summer break! If you’re daydreaming of laying on some remote beach, cutting a few of your expenses...

How To Spring Clean Your Finances

If you’re anything like me, then you might religiously check your budget and track your personal expenses every month so you can stay on top of things. However, staying on top of things doesn't necessarily mean you are void of having no emergency savings, a mountain...