Budgeting can seem hopeless when you’re not making enough money, but that is even more reason to create one!

Budgeting can seem hopeless when you’re not making enough money, but that is even more reason to create one!

It doesn’t matter if you’ve lost your job, you have too much debt, or you just don’t make enough money, either way, the bills still need to be paid.

When there isn’t enough money to pay for all your expenses, it can be tempting just not to make one at all.

If you don’t have enough money to pay your bills, you need a budget even more.

Things can get difficult when you’re not making enough money, but things can be easier when you start to budget and plan your paycheck.

When you’re on a low-income budget plan, you have to write down your budget and bills so you can quickly stay organized.

And when you’re budgeting finances on a low-income, making a plan and sticking with it can benefit your finances in the long run.

Here is how to budget when you don’t make enough money.

Step 1: Write It Down

It doesn’t matter whether you already know you’re not making enough money or you are, you still need to write things down.

While computer programs can make budgeting easier, it is essential to go back to pen and paper for this exercise. Writing it down will not only help you remember what expenses you have better, but you will also be able to prioritize better.

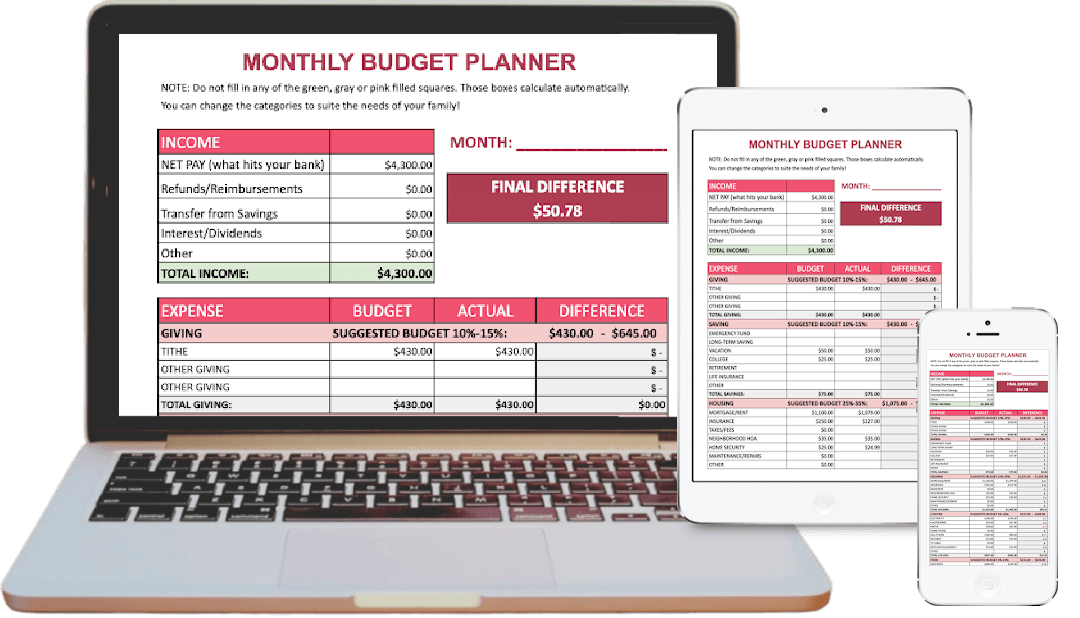

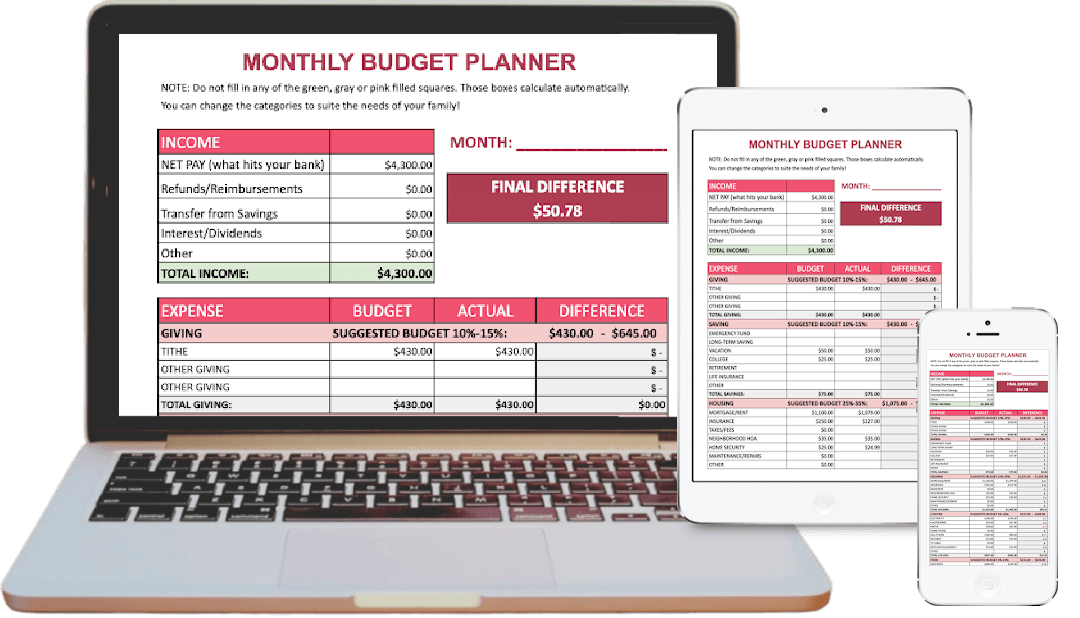

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

As you write down your budget on paper, you are going to be a more efficient spender since you will be able to see where every penny and dollar is going. If you are on a tight budget, you will need to follow a budget even closer than others might.

Step 2: Set Your Priorities

If you know how much you will make each month, and you know it’s not enough to pay for everything you need, you still need to prioritize the money out of each paycheck.

To get started with your budgeting finances on a low income, start by creating a list in order by what items need to be paid first based on priority and due date.

For example, your list might look like this: food, power, water, rent, insurance, phone. Make sure to include things such as food and power first so you can cover your basic needs.

Here’s how you can still eat healthy on a budget!

Even if you are struggling to make ends meet when you’re not making enough money, you can still feed yourself for very little. Learn how to coupon to save your grocery bill.

Step 3: Make A Plan For Your Paycheck

After you have determined what needs to be paid and in what order, it’s time to decide where each paycheck will go. If you are using government assistance programs, include these as well.

You can have a budget for each paycheck, or you can just dictate which paycheck will pay for what based on your list.

You will now have a list of your expenses by priority, as well as, what paycheck will cover which expenses. This will help guide you when you’re not making enough money.

Step 4: Stick To It

While it can be tempting just to throw out the entire low-income budget plan when you’re not making enough money, it’s essential that you stick to this plan.

If you are in debt, this plan can help reduce the amount you continue to go into debt. If you are struggling to find a job, this plan can help cover your basic needs.

No matter how discouraged you may be, stick to your budget at all costs!

Step 5: Make More Money

The answer to your problem of not having enough money might sound simple, make more money.

The truth is that if you don’t have enough to cover all your expenses, you will need to find a way to bring in more money each month when you’re not making enough money.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Here are some great ways to boost your income, no matter how much time you have.

Step 6: Make Some Calls

When you are unable to pay your bills, the first thing you need to do is call the company and explain your situation when you’re not making enough money.

If this is something temporary, they may be able to work with you to find a solution that will work for you and them. When this is something longterm, they may be able to work with you to find a way to reduce your bills or refer you to someone who can help.

Once you have your budget in place, call the companies you can’t afford to pay or won’t be able to pay and see what they can do to help you.

Just because you don’t have much money doesn’t mean you shouldn’t make a budget.

A budget gives your money a dedicated path to go so you can make each dollar stretch as far as it will go.

Things can get difficult when you’re not making enough money, but things can be easier when you start to budget and plan your paycheck.

When you’re on a low-income budget plan, you have to write down your budget and bills so you can quickly stay and be organized to better your financial future.

And when you’re budgeting finances on a low income, making a plan and sticking with it can benefit your finances in the long run.

Follow these tips to help get your finances back on track, and do the best you can with what you have.

YOUR TURN: Have you made a written budget? What steps will you take to manage the money you are not making enough money? Let me know in the comments below!

More Fun Articles To Read: