If you’re anything like me, then you might religiously check your budget and track your personal expenses every month so you can stay on top of things.

If you’re anything like me, then you might religiously check your budget and track your personal expenses every month so you can stay on top of things.

However, staying on top of things doesn’t necessarily mean you are void of having no emergency savings, a mountain of debt up to your ears, and about $100 in your bank account to get you through the rest of the month.

Regardless of your financial situation, giving your finances a good spring cleaning can make your life just a little easier.

With these simple personal finance tips, you can easily identify where to start your financial cleanup.

Then, with these personal finance organization ideas you’ll be able to quickly organize your finances so that you can reach your finance goals.

And, your personal expenses will benefit by giving yourself a clean slate with which way is the best way to direct your money this year.

Besides, you’re already cleaning your home, so why not spring clean your finances too!

Cancel Subscriptions & Memberships (And Bank Fees)

Go through your online banking transactions or credit card statements in your personal expenses and write down any subscription or membership charges that you have.

Once you have your list, go through and ask yourself if you are honestly using them all and need to keep paying for them.

This is one of the simple personal finance tips that has the potential to save you quite a bit of money each month. But you have to be honest with yourself!

Then, go through each and every company on your list and call and cancel or negotiate a lower rate. I used a negotiation service a few years ago called BillShark.

The Pro: they do the calling and talking for you (so nervous nelly me didn’t have to ask for any discounts etc)

The Con: It costs 30% of the amount they save you TOTAL. That can be quite a bit. AND you have to pay that upfront, which is before you’ve actually recognized any discounts yet. <womp> <womp>

Here’s their strategy: they simply called and asked if they could sign a two-year contract in order to reduce the bill overall. Well that’s easy! I can do that MYSELF (thank you very much).

One thing I don’t like to do, however, is to call to get a bank fee refunded to me. That’s where Harvest comes in! They’ll do it for you! And, even better, they don’t get paid until AFTER they get the money back for you (so you’re only paying out of the refund). Their fee is 25% of what they get back.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Cut Unnecessary Spending

In addition to getting rid of any clutter that you don’t need while spring cleaning your home, consider cutting any unnecessary spending from your personal expenses as well.

Are you eating out more than you should? Spending money on useless things you don’t need?

These can all be red flags that you need to do some cutting in your budget and personal expenses. Instead, find a better use for that money and invest in something that will bring you joy in the years to come.

We were worried to get rid of cable and break up our “bundle” but when we did, we ended up saving $604 by cutting cable!

Reevaluate Your Insurance Bills

When was the last time you reviewed your health, home, life and car insurance?

A lot can change in a year, and rates might not have been as great as they were when you started.

Make a note on your calendar to call your provider before your renewal and see if you can get any discounts to reduce your payment.

You owe it to you personal expenses to find the best deals for your budget.

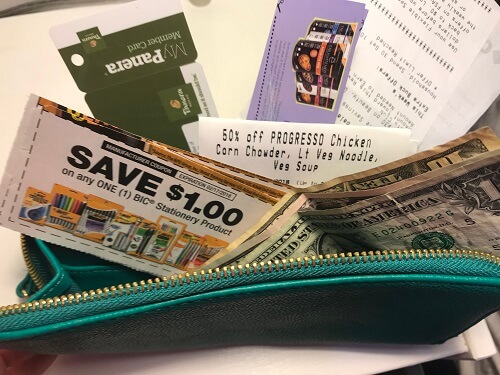

Clean Out Your Wallet And Purse

I mean this literally!

When was the last time you took the time to clean these things?

If you’re busy like me, then it’s probably been a while! This is the start of some great personal finance organization ideas. You truly have to get organized in order to get your finances in order.

You may find spare cash, change, or even outdated checks that you didn’t know were in there. The last time I cleaned my purse, I found a Target Gift Card I’d forgotten I had!

Don’t miss out on money you already have but have forgotten to use! Find it and use it today!

You can easily add to your personal expenses by not using what you already.

Check For Unclaimed Money

Did you know the government is holding more than $40 billion in unclaimed money?

Some of it might be yours! I was shocked to find that my husband had $120 sitting in the State of Florida’s bank account just waiting for us to claim it!

All we had to do was submit a form to prove that we lived at the prior address where the check was originally mailed (but we had never received).

I’m sure there are loads of ways to search for unclaimed government money to add to your personal expenses, but I’ve composed a list of the top 10 websites I trust here in a Google Doc.

If you live in Florida then the site to check for unclaimed money is FLTreasureHunt.org. For all other states, use my Google Doc list to make sure you are getting a legitimate source.

Revisit Your Goals

Did you make financial goals at the beginning of the year? If so, take the time to dig them out and go through them again.

Are you on track for completing them by the end of your designated timeline? Do you need to make additional changes to your budget to make it happen?

If the answer is no, then thankfully you still have time to adjust or even completely overhaul your goals.

Your personal finance organization ideas might look different than other people, but getting those goals organized and in plain view can help you achieve them!

Your personal expenses and goals can only work when you work for them!

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Are You Maxing Out Your Retirement Contributions?

It might seem like too early to think about your retirement, but the truth is that most of us don’t contribute enough to retire!

If you have an employer-matched retirement plan, make sure you are maxing out those contributions as often as possible.

That’s free money that reduces your taxable income as well as helps you to build up for your financial future.

It can only help your personal expenses when you go to retire.

Here’s how to “double up” when you contribute to your retirement plans.

Time To Get Organized

If you had to find your tax return from seven years ago, could you find it?

If you had to dispute a charge on your credit card, could you find the statement and receipt?

When it comes to your finances and personal expenses, you can’t manage anything you don’t know or have.

While you can’t keep track of every single thing, you should at least have a clue of where to find it.

Take the time to at least gather it all together to set up a system for your financial documents. You’ll sleep better at night knowing you’ve got everything in one place should you need it.

Giving your personal expenses a spring cleaning can change the way you manage your finances.

With these simple personal finance tips, you will be able to easily identify where to start your financial cleanup.

Then, with these personal finance organization ideas you can quickly organize your finances so you can reach your finance goals.

And, your personal expenses can benefit by giving yourself a clean slate with which way is the best way to direct your money this year.

You wouldn’t let your home get out of hand, so don’t let your finances get out of hand either.

YOUR TURN: What is one of your personal expenses needs an overhaul? Let me know in the comments below!