What would you do if you had an extra $10,000 (yes, TEN GRAND) in your pocket today?

What would you do if you had an extra $10,000 (yes, TEN GRAND) in your pocket today?

Just think of what an additional $10,000 a year could do for your family.

A few simple changes in your shopping habits can really add up to some BIG savings.

With these how to save $10,000 in a year tips, you’ll see just what you need to do in order get that money staying where it should be – in your savings account!

Plus, when you learn how to save ten grand, you’ll learn to be more frugal in all areas of your life.

And, when you learn how to save $10,000 in a year by frugal living, you’ll be able to save even more money to put towards debt or savings.

The reality for many of us is that an extra ten grand would cover our living expenses for a few months, pay off the remaining debt we owe, or help fund our child’s college tuition down the road.

No matter what financial situation you are in, I believe you can save an extra $10,000 this year!

Read on to find out the specific ways you can save TEN GRAND this year!

Stop Eating Out

In this example, I am going to use a family of four, but of course, adapt these numbers to fit your family.

The average person will spend roughly $8-$12 on each meal they eat out, and this is usually before tip.

For the sake of our example, I’m going to use $10 a person. For a family of four, this would be $40 total, not bad right? Although it’s never that cut and dry. You see when families dine out; there’s usually appetizers and soda involved making your total closer to $15 a person. Now your total would have reached $60 for your family of four, and including a 20% tip, you’ve now spent $72 on one meal for your family.

Even if you only eat out once per week, that is still $3,744 a year!

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

However, most families will go out to eat twice per week doubling the expense for a total of $7,488.

Instead of going out to eat, keep your hard earned $3,744 in your pocket and make your meals at home. Can you believe you can save this much each year and add it to your ten grand in savings?

When we were dead set on paying off debt, and my hubby was working weird (3rd shift) hours, I made “A Year Of Crockpot” meals to save time. I didn’t have the time to cook so I’d just dump everything in the morning and by mid-afternoon we’d have a meal ready. My hubby took the leftovers to eat at work the next day. You could also try a one-pot/pan meal to lessen your clean up. I’ve got a fantastic resource for that called the Simple Dinner Formula.

Back up a second, because I want to be sure you realize just how much of an impact this has on your finances. Even if you only spend our original number of $40 per week, that will amount to $2,080 in one year.

I know it will feel odd, but give yourself a raise and eat in instead. It’s just one way on how to save ten grand!

Cut Your Cable Bill

When I was a kid, Netflix wasn’t even invented yet, and the idea of streaming your shows didn’t exist. In those days, if you wanted to watch something you had to have cable.

Cable is no longer a necessity, and there are so many wonderful alternatives to cable that work just as efficiently, especially if you’re trying to save ten grand.

If you still want to enjoy the Olympics, Super Bowl, and watch the ball drop on New Year’s Eve, purchase a digital antenna to watch live TV without cable (they are only around $80 total, not monthly!).

If you want to watch some of your favorite shows, streaming services such as Netflix, Hulu, Vudu, and Sling TV can allow you to watch all the shows and movies your heart desires.

At $100 or more each month, you can’t afford not to cut your cable bill!

When we cut our cable bill a year ago, we found that it saved us over $600!

A friend cancelled her cable after they upped her cost to $180 each month. After keeping just the internet, she is saving $1,680 each year by cutting her cable!

With these how to save $10,000 in a year tips, you’ll have saved up the money in no time!

Go On A Clothing Ban

The average American household spends about $2,000 on clothes each year. This includes outerwear, bathing suits, work clothes, and even yoga pants. And don’t forget the ever-so-important fashion item: SHOES!

If you are working at a job that earns you $20 per hour, this means you will work for 100 hours just to afford your clothes!

The truth is that many of us have all the clothes we need right in our own home!

Unless you have a growing toddler or kids in the house, you can probably get away without buying new clothes for a while.

Save that $2,000 per year on something more important and learn to take care of the clothes you have (we’ll leave the shoe spending in the budget for right now). Add this to your ten grand and you are well on your way to having a nice savings account!

It’s a great way on how to save $10,000 in a year by frugal living.

Stop Buying Books & Magazine Subscriptions

It always stuns me to see how many people pay for their books. The average cost for a new book is about $12, and this is if you can find a bargain. This does not include the price of an audiobook, which is closer to $20 or an ebook.

If you are buying reference, textbooks, or cookbooks, you could spend even more.

Avid reading families will pay nearly $288 for books each year if they purchase a mere 12 books a year (only one a month). Which for a four-person family, comes out to only three books per person for the entire year!

Instead of buying your books get free books instead!

BONUS DOWNLOAD

Feel Less Stress While Paying Off Debt

Download this FREE Guide to have more peace & less stress while getting out of debt.

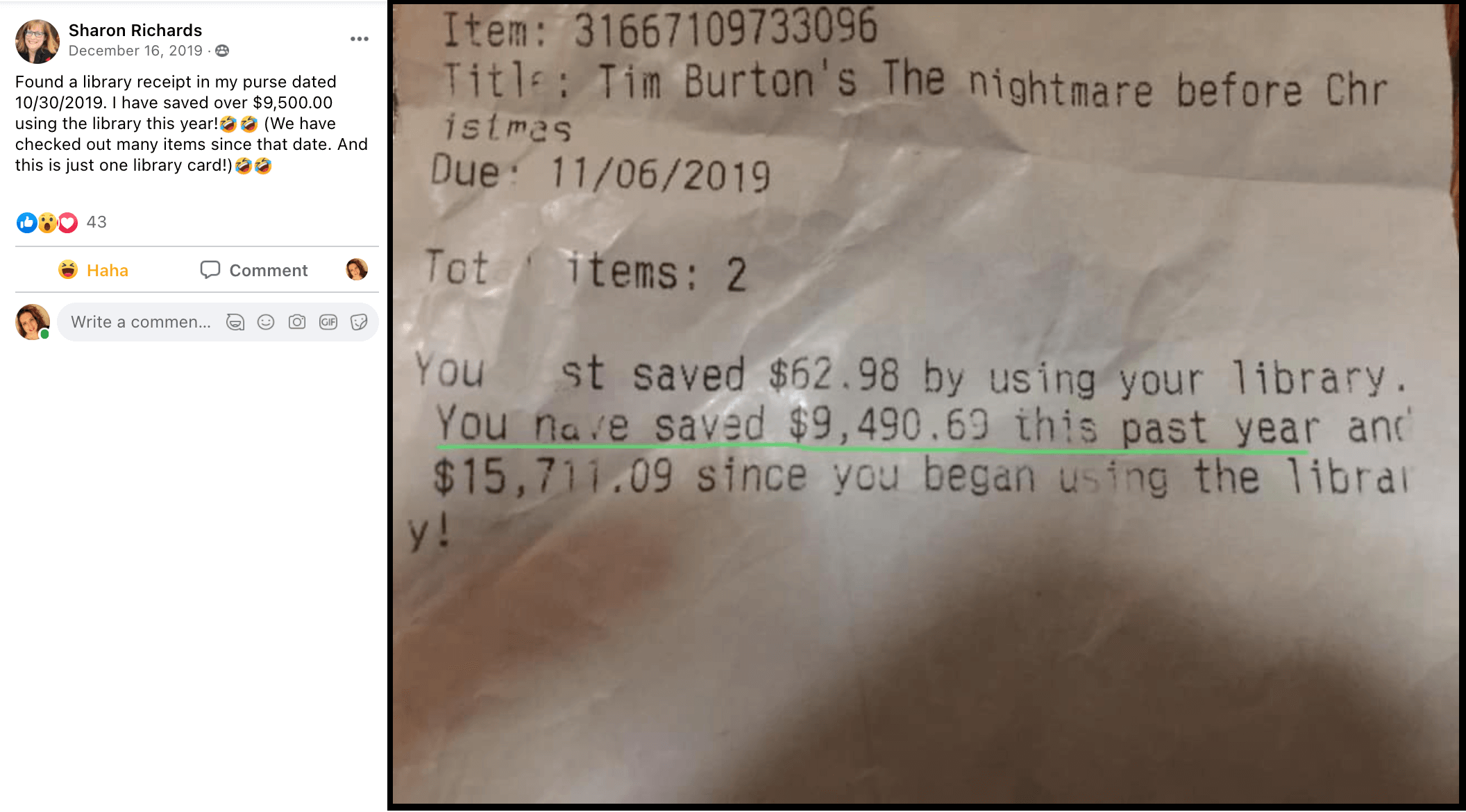

My friend Sharon Richards shared on Facebook that she saved over $9,500 in 2019 by using her local library. How amazing is that?!

Use your local library or Prime Reading if you have a Prime membership and stop paying for your books.

See, you really can save a bundle when you are trying to learn how to save $10,000 in a year by frugal living.

It’s a great way to reach that how to save ten grand savings!

Adding It All Up

Were you keeping up with all that math along the way? It’s time to summarize the savings towards ten grand.

Stop Eating Out Twice A Week: $7,488

Cut Your Cable Bill: $600

Clothe Yourself Outta Your Closet: $2,000

Get FREE Books: $288

TOTAL = $10,376 ($6,632 savings if you only eat out once a week)

As you can see, with a few simple changes, anyone really can save ten grand this year.

It may involve changing some habits you’ve had for years, but I promise it will be worth it in the end!

If you think you can’t make it for a year, take 52 sheets of paper and write inspirational sayings on each one to help you go 52 weeks without clothes and restaurants.

As each week passes, count down your time and count UP your savings account!

Watching progress happen always inspires you to keep going!

So as you can see, these how to save $10,000 in a year tips, will help to keep that money staying put where it should be – in your savings account!

Plus, when you learn how to save ten grand, you’ll learn to be more frugal in all areas of your life.

And, when you learn how to save $10,000 in a year by frugal living, you’ll be able to save even more money to put towards debt or savings.

YOUR TURN: How often do you buy new clothes? How often do you buy books? Let me know in the comments below!