Couple goals, we’ve all got them including how to manage money as a couple.

Couple goals, we’ve all got them including how to manage money as a couple.

You’ve probably already heard the statistics about money and marriage; “more than half of marriages end in divorce because of money.”

And it’s nothing to scoff at because money problems are the second leading cause of those divorces (second only to infidelity).

So let’s think about this mathematically, if the number 2 cause of divorce is because of financial reasons, then that means if we gain control of our money with our spouse, then we have at least a 60% percent chance of making it.

I’ll gladly take the odds that are in my favor.

Money might be a taboo subject, but learning how to work together as a team to manage money as a couple can lead to better money management in the long run.

These managing money as a couple tips will help to prevent fighting and the tension that often occurs about money.

And these couple goals of handling your money like a team, will help to guide you to create goals as a team.

Plus, how to manage money as a couple may not come easily to some, but with these tips you can quickly determine how to take care of your money together.

Here is how my husband James and I try to stay on the same page and manage money together as a team.

Start With A Joint Bank Account

The first big (exciting) step for your couple goals is to officially combine your finances.

While there are significant arguments for having separate accounts, if you are struggling to combine your finances, you might need to reconsider.

Having multiple accounts can lead to a mine vs. your money fight. When you combine your accounts, you are forced to put the two of them together.

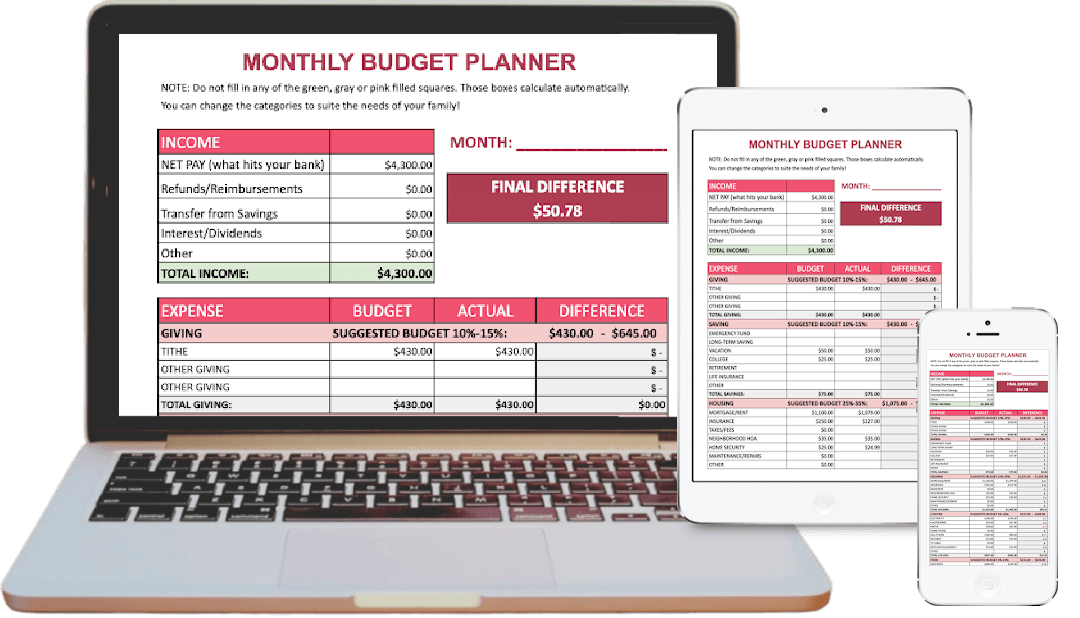

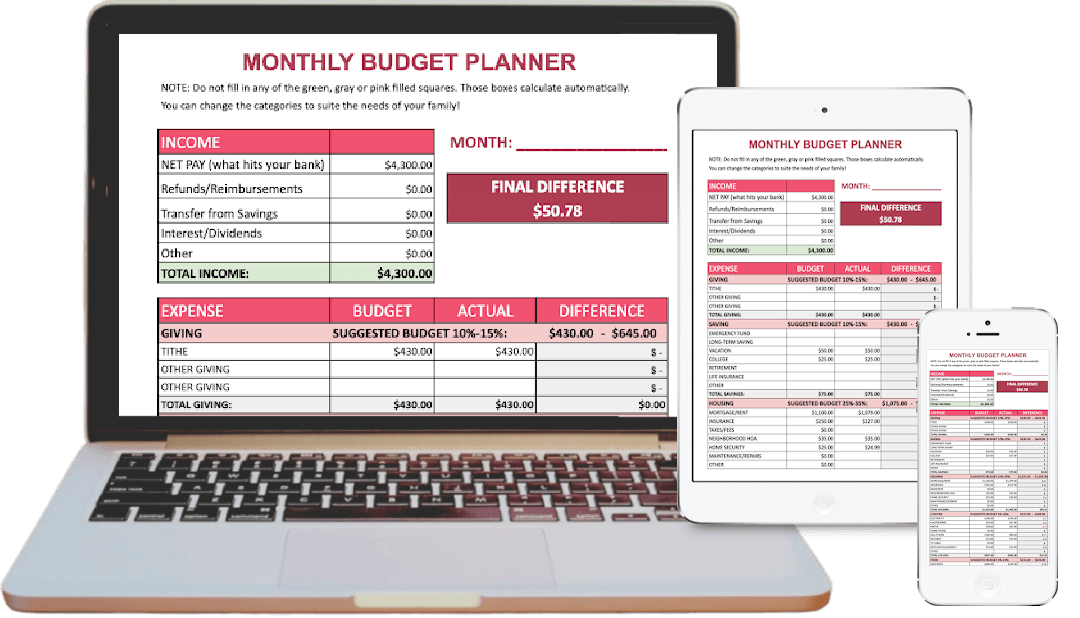

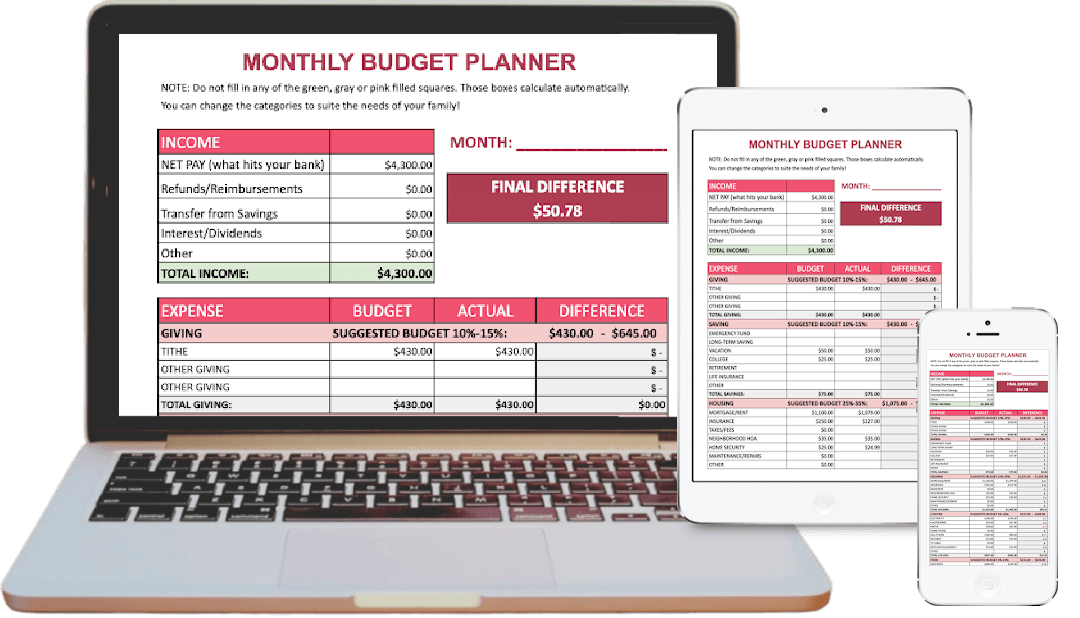

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

However, having a joint bank account will help you start viewing your incomes as combined, and help you see the greater picture together.

Here are some tips to merging your money after marriage.

Divide The Responsibilities

Sharing finances can turn into a disaster if you aren’t careful.

For your couple goals, share some of the financial obligations. Then, both parties will feel included in the finances and feel like they are involved.

Be clear about who should be in charge of paying what, and who will be in charge of the money for each bill.

During a tight spot in our marriage, we were late on our electric bill auto-payment. Unfortunately, the electric company in our area does not give any grace, they have a “one and done” requirement for the auto-pay side of things and for an entire YEAR we had to make the payment for our electric bill up at Amscott. Not only was it embarrassing. It was a huge HASSLE! But right when it happened, that night at dinner I told James and he decided to be in charge of that payment each month so that we knew it would get paid.

Making sure you identify who is responsible for making sure certain payments are completed as well as the timing of bills are happening inside your joint checking account will keep you from making payments late and avoid conflict later when unexpected expenses occur.

Set Long-Term Goals As A Team

It might sound silly to make couple goals when it comes to your finances, but setting financial goals will help you communicate better as a couple and help you decide what to save for.

This can help you save up for a house, plan for retirement, or even plan on taking that big trip will allow you to share what you want your future to look like.

Having big plans and something to look forward to will help strengthen your relationship and can even make you more motivated.

When you have goals in mind as a couple, it can make building and sticking to a budget easier. If you are saving and living frugally with no goals in mind, it can be hard to keep from overspending.

Create Your Budget TOGETHER

The key word in this phrase is the together part! When creating your budget, it’s okay for the spouse who is better with money to create an overall outline of the budget, but you should both be finalizing and making it together!

Remember, there is no I in team! Put your couple goals on the forefront to making your fiancial goals work.

If you ever want to be on the same page with your spouse when it comes to money, you have to sit down together and decide where your money will go. Start with the easy stuff such as bills and regular expenses. Figure out how much money you will need to put toward those expenses, and look for ways to lower them if possible.

Once you’ve tackled those expenses, now you can branch out into the more “fun” categories such as eating out, entertainment, and the additional categories. Decide what you can reasonably spend in these areas as well as what you want to put that extra money toward.

You should not only make decisions about where to spend your money but also how to save some of it. Create savings goals with your spouse, and make those goals a line item in your budget as well.

Here are 7 tips to prevent money conflict in marriage.

Think About The Needs Of Your Household

As a couple you need to figure out the needs of your home. This includes items such as rent, electric, groceries, car payments, debt payments, and any other expenses that are essential to the survival of your household.

While there may be some wiggle room regarding how much you can spend on these items, there is usually some way to save money on these expenses.

For example, you can buy a used car instead of new, coupon to save money on groceries, or forego cable to save more money.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Where do you each stand on eating lunch out each day for work? Or meeting up for weekly playdates at Chick-fil-A? The money to pay for these things needs to be factored into your combined budget.

While it’s important to prioritize your needs over wants, you should still tackle these life decisions together as a team.

Always Plan To Live On Only One Income

When James and I first got married, we had no children so we both worked full time.

We decided right then that we would always “plan” for only having one income for our couple goals. That way our expenses were always less than what we were making, or, if we only had one income (which is what happened all these years) then we would be okay financially.

If you are a two income family, then living on one income can help you reach long-term savings goals faster, allow one partner to stay home and watch the kids, and may even help you get out of debt.

As you talk with your partner about joint finances, don’t forget to discuss this topic in great detail to see if it’s right for you.

I wrote a whole article about how you can live off one income.

(Tough Love) You Gotta Have Regular Money Meetings

It is not up to one person to manage all the financial tracking, spending, and decision making. It’s also not up to one person to handle all of the finances.

Each week, sit down with your spouse to make sure you are on track with your budget and your couple goals. During these meetings, you can also discuss planned or unplanned expenses that may come up during the month.

We like to talk about FUN stuff coming up as well, such as Disc Golf Tournaments and any travel plans. That way we have something to look forward to as we discuss the potentially hard stuff too.

You may need to have meetings more frequently at first, but over time you can move it to once a month.

Plan An Undistracted Meeting Time

You should not try to plan a weekly meeting with your spouse when you’re overtired, exhausted, or hungry. This can lead to feeling rushed and make your meeting time even more stressful.

We like to have our meetings on the weekend when we know we’ll have plenty of time to talk without constant interruptions.

BONUS FREE DOWNLOAD

Create A Plan For Your Money

These FREE Budgeting Spreadsheets will help you keep a pulse on your money (from the palm of your hand).

Plus, we like to keep our “date night” truly about each other. There’s no need to bring money frustrations to a date!

Be Patient

If your husband is a natural spender then living on a tight budget might make them pretty nervous.

If your spouse is not used to being a part of the financial discussion, then it’s easy to get overwhelmed when budgeting.

Be patient with your spouse, and know that you might not get it right the first time. This is also possible if you are building a budget from scratch.

Make sure that both parties have an equal say in the discussion, and work together to develop your budget for your couple goals.

Managing your money as a couple doesn’t mean you have to feel deprived or be difficult.

These managing money as a couple tips will help to prevent fighting and the tension that often occurs about money.

And, these couple goals of handling your money like a team, will help to guide you to create goals as a team.

Plus, how to manage money as a couple may not come easily to some, but with these tips you can quickly determine how to take care of your money together.

If you follow these tips, you’ll be on the right track to financial success as a couple, and you’ll manage your money better as a couple.

YOUR TURN: What couple goals have you discussed about your finances? Let me know in the comments below!

More Fun Articles To Read: